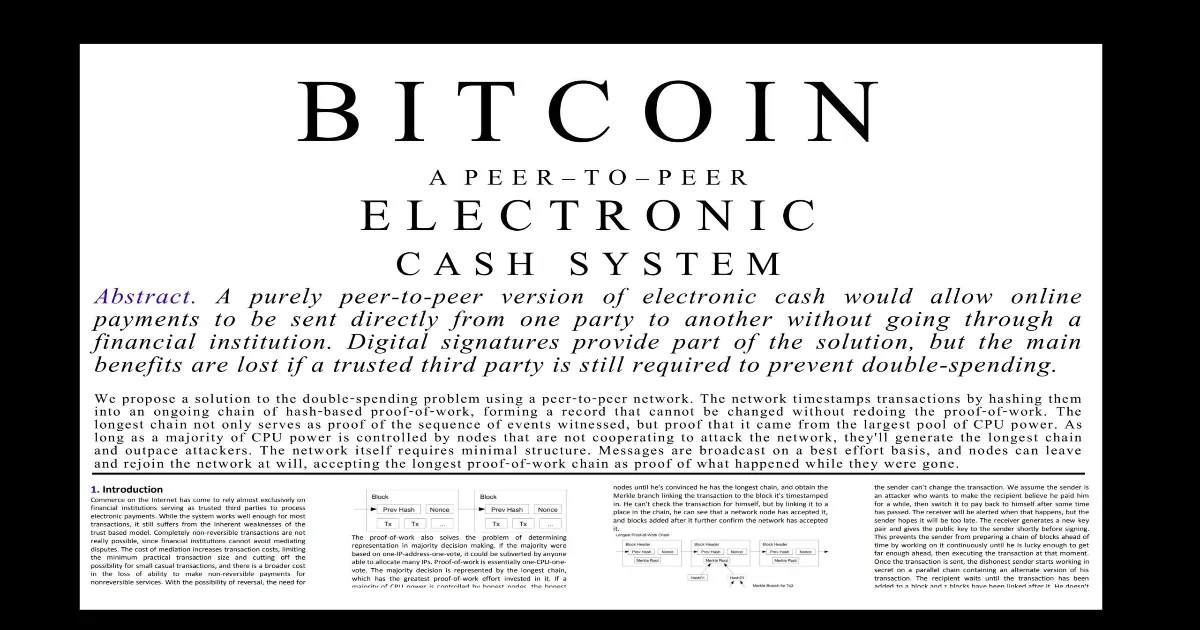

What Has Bitcoin Become 17 Years After Satoshi Nakamoto Published The Whitepaper?

NeutralCryptocurrency

Seventeen years after Satoshi Nakamoto released the Bitcoin whitepaper, the cryptocurrency has evolved significantly, impacting finance and technology. This milestone prompts reflection on Bitcoin's journey, its challenges, and its role in shaping the future of digital currencies. Understanding this evolution is crucial as it highlights both the potential and the risks associated with cryptocurrencies.

— Curated by the World Pulse Now AI Editorial System