Firma Strategy przeniosła 2.45 mld USD w Bitcoinach do nowych portfeli. Likwidacja czy restrukturyzacja?

NeutralCryptocurrency

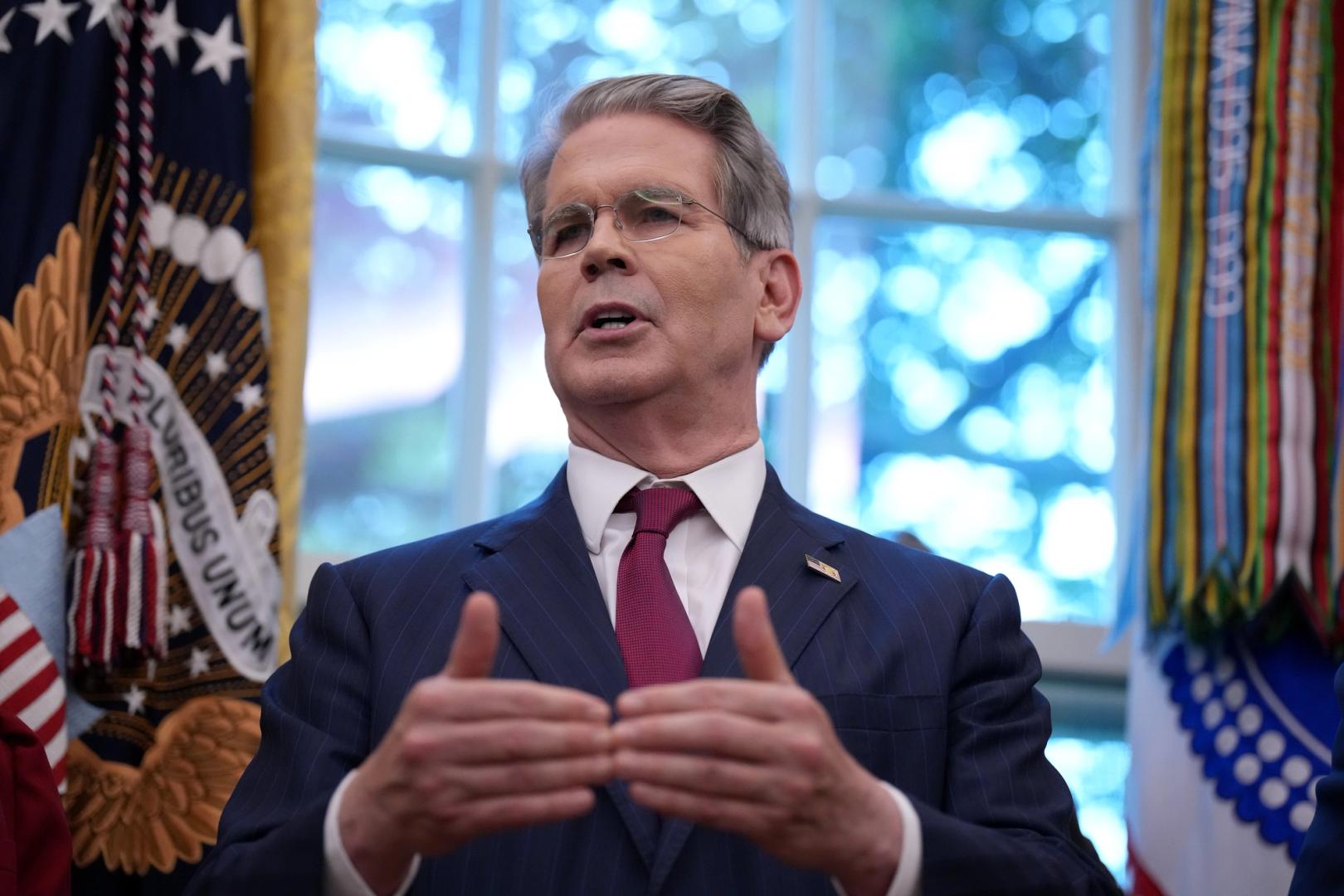

Michael Saylor and his company Strategy have made headlines again by transferring $2.45 billion worth of Bitcoin, specifically 22,704 BTC, to new wallets in just nine hours. This significant move has sparked speculation in the cryptocurrency industry about whether it indicates liquidation or restructuring. As the largest corporate holder of Bitcoin, Strategy's actions are closely watched, and this latest transfer has raised questions about their future plans and the overall market dynamics.

— Curated by the World Pulse Now AI Editorial System