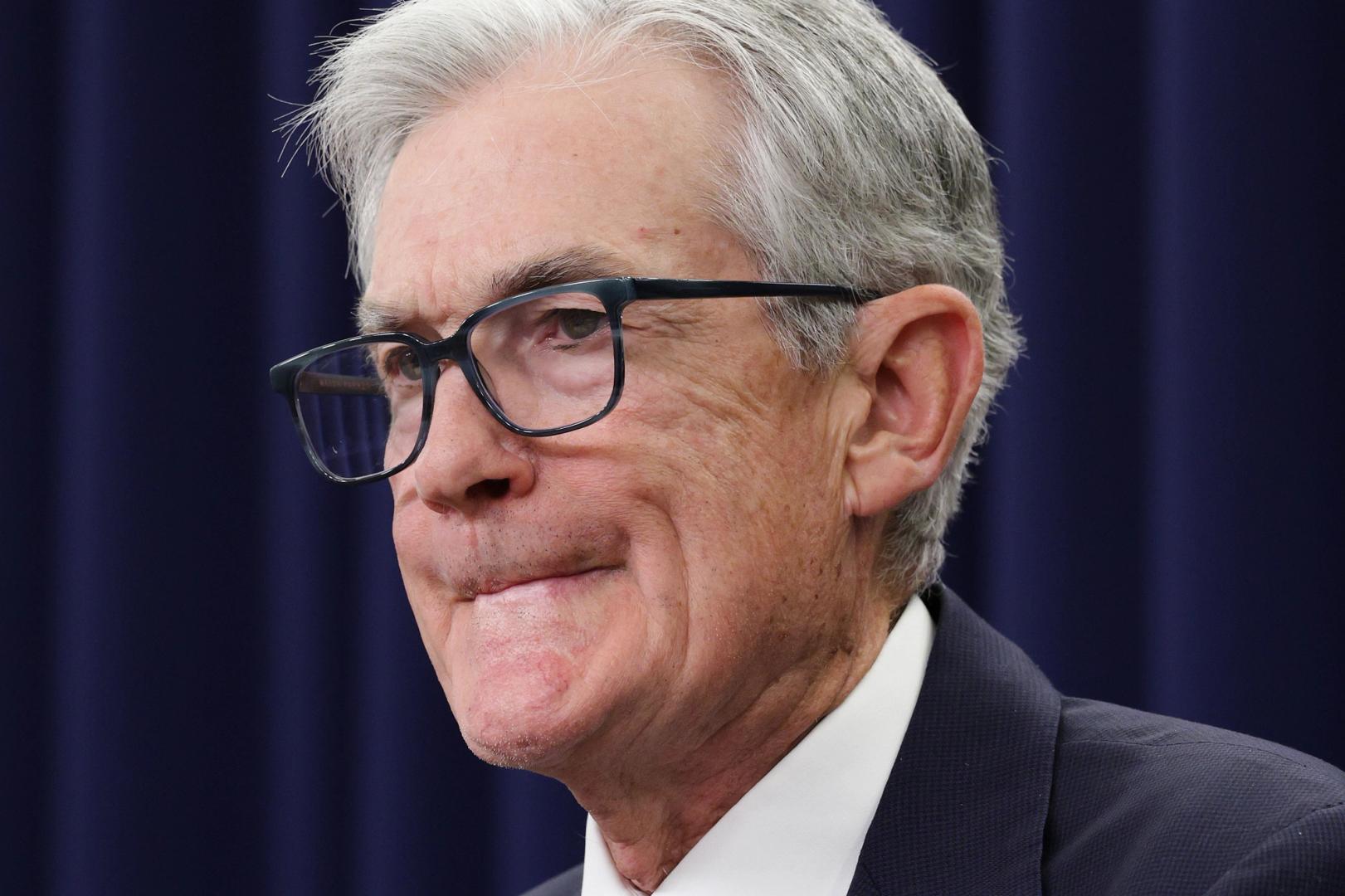

Jerome Powell warns of employment risks as Fed cuts rates again

NegativeCryptocurrency

Jerome Powell, the chair of the Federal Reserve, has raised alarms about potential employment risks as the Fed implements another rate cut of 25 basis points and concludes its quantitative easing program. This decision comes amid concerns over slow job growth, which could impact the economy's recovery. The Fed's actions are significant as they reflect ongoing challenges in the labor market, and Powell's warnings highlight the delicate balance policymakers must maintain to foster economic stability while addressing employment issues.

— Curated by the World Pulse Now AI Editorial System