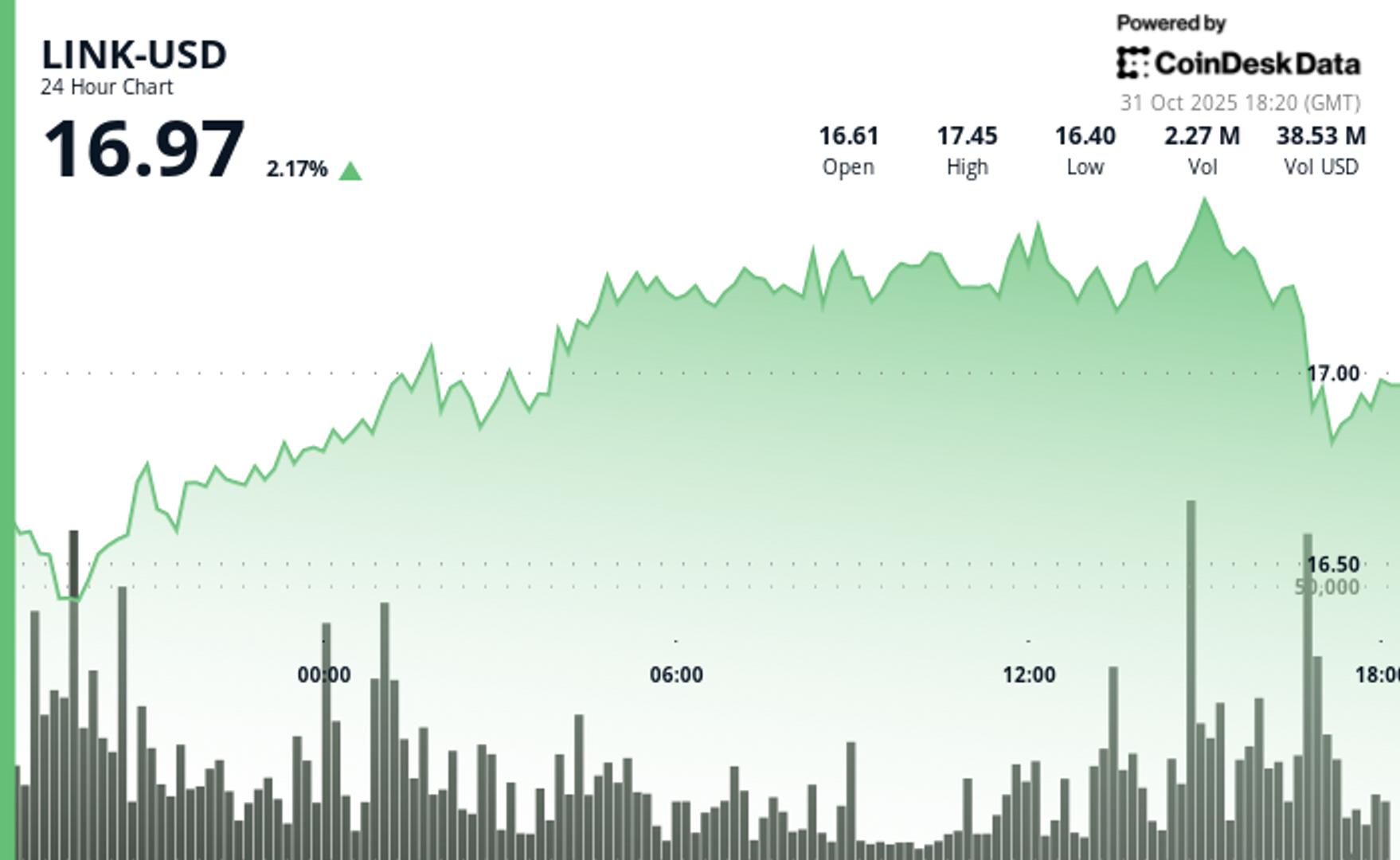

Chainlink's LINK Bounces 3.6% From Lows; Stellar Integration Expands RWA Reach

PositiveCryptocurrency

Chainlink's LINK has seen a 3.6% bounce from its recent lows, thanks to Stellar's integration of Chainlink's Cross-Chain Interoperability Protocol (CCIP), Data Feeds, and Streams. This collaboration is significant as it enhances the flow of tokenized assets across different blockchain networks, potentially increasing the utility and adoption of both platforms. As the blockchain ecosystem continues to evolve, such integrations are crucial for fostering interoperability and expanding the reach of real-world assets.

— Curated by the World Pulse Now AI Editorial System