Is The White House Pumping Hyperliquid? Whale Denies Trump Insider Trading as HYPE Price Prediction Targets $50

NegativeCryptocurrency

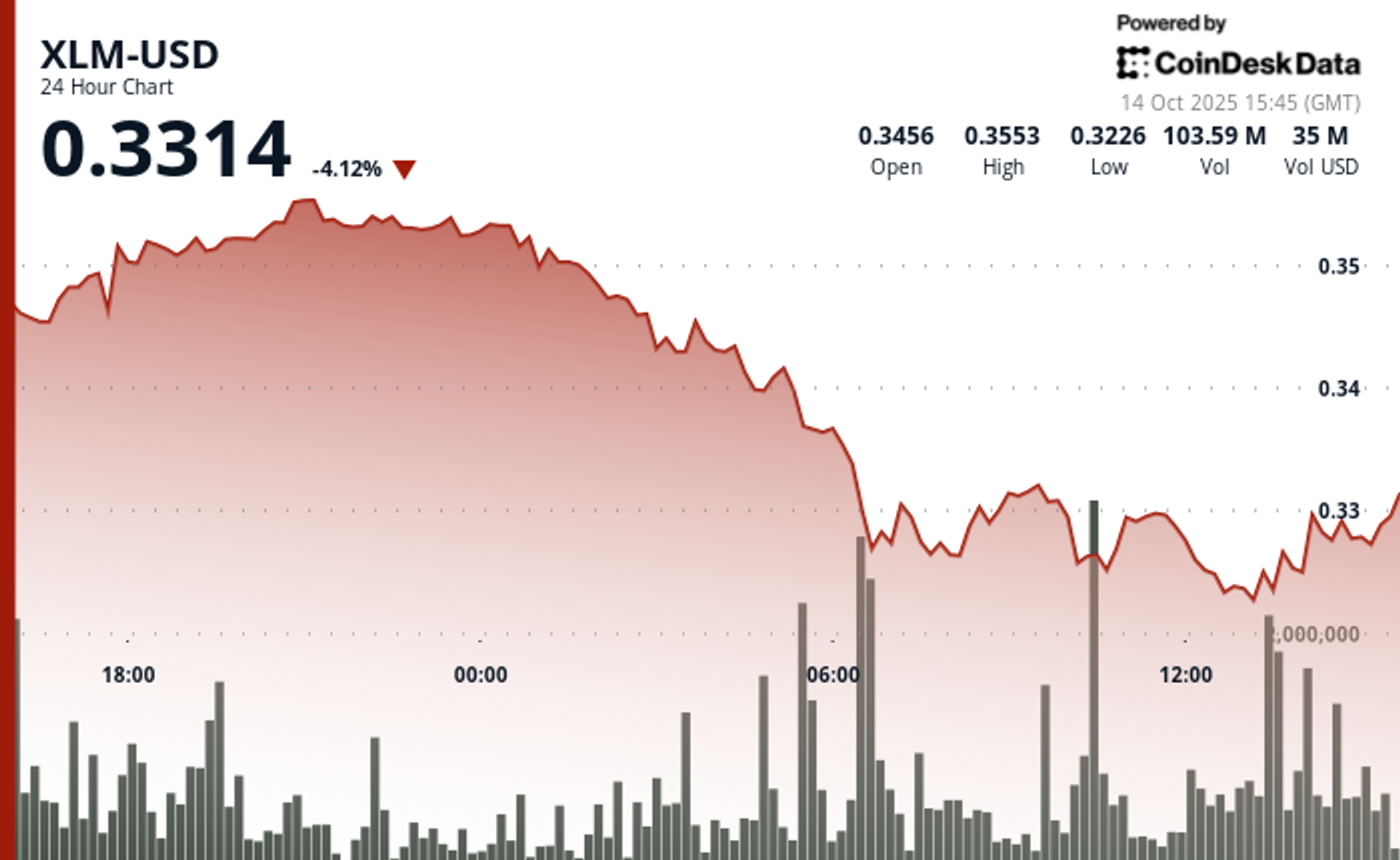

On October 10, the cryptocurrency market faced a catastrophic downturn, with many altcoins plummeting in value, some nearing $0. This event, described as an apocalypse for traders, has raised concerns about market stability. Despite the turmoil, predictions for HYPE remain optimistic, targeting a price of $50. The situation is significant as it highlights the volatility of the crypto market and the potential implications of insider trading allegations involving high-profile figures like Trump.

— Curated by the World Pulse Now AI Editorial System