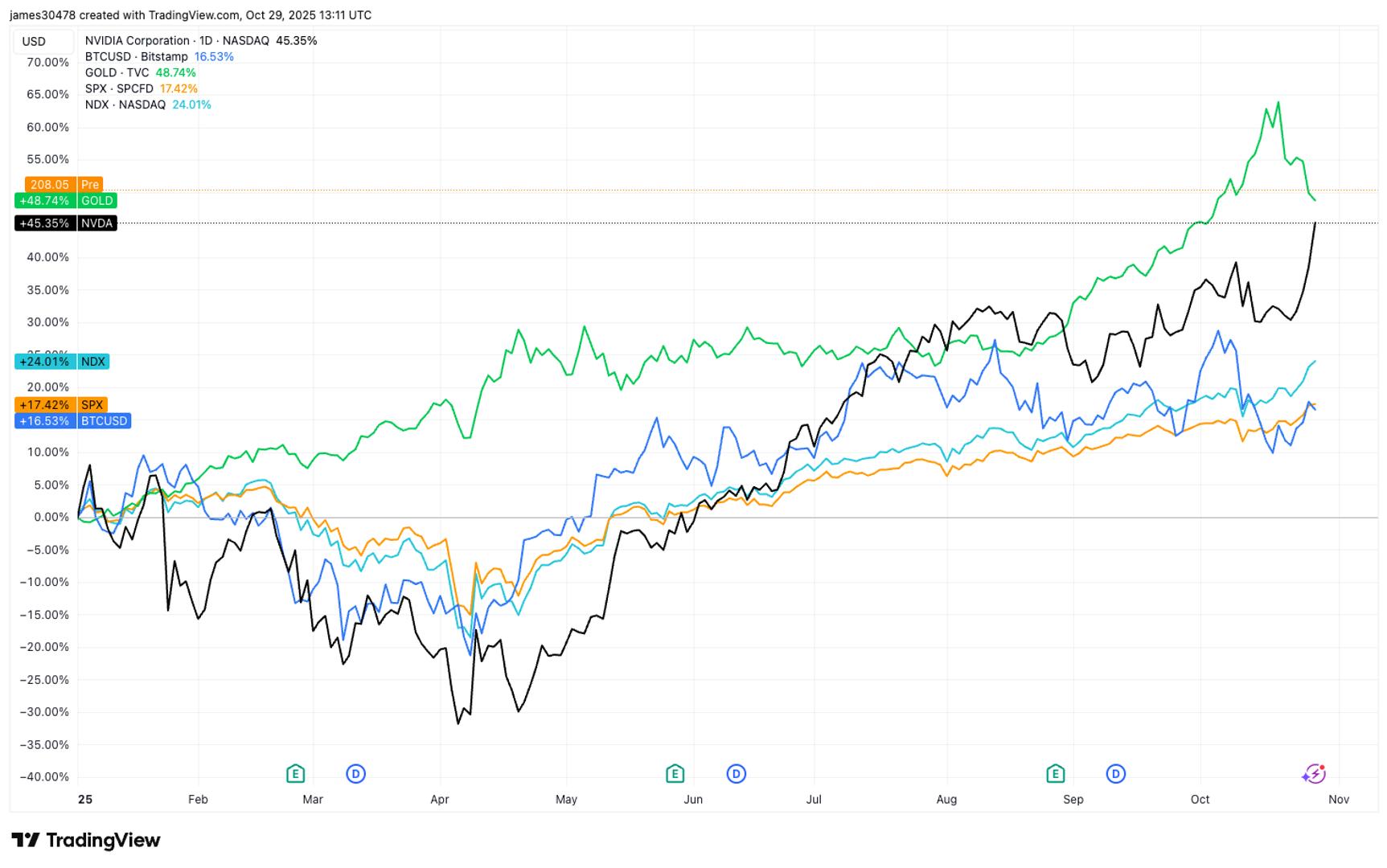

US stocks surge as Nvidia becomes first company to hit $5 trillion valuation

PositiveCryptocurrency

US stocks are on the rise as Nvidia makes history by becoming the first company to reach a $5 trillion valuation. This milestone not only reflects Nvidia's impressive growth but also boosts overall market sentiment, contributing to record highs for major indexes. Investors are optimistic, and this surge could signal a strong future for tech stocks and the economy.

— Curated by the World Pulse Now AI Editorial System