Institutions Drive CME Crypto Options to $9B as ETH, SOL, XRP Set Records

PositiveCryptocurrency

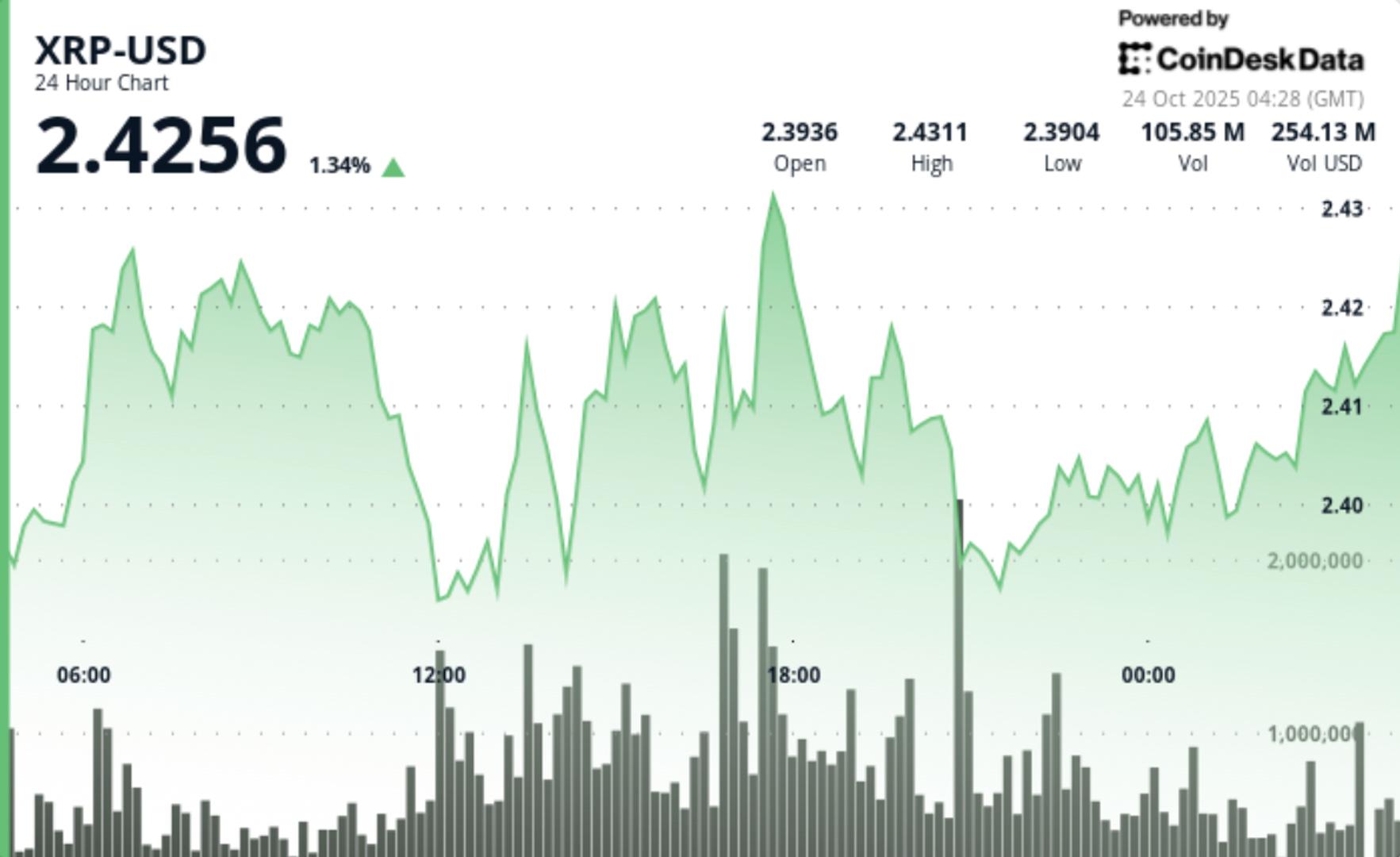

The recent surge in open interest across CME's regulated crypto markets, which has jumped 27% since October 10, highlights a growing confidence among institutional traders in cryptocurrencies like Ethereum, Solana, and XRP. This increase to $9 billion in crypto options indicates a significant shift in market dynamics, suggesting that larger players are increasingly willing to engage with these digital assets, which could lead to greater stability and legitimacy in the crypto space.

— Curated by the World Pulse Now AI Editorial System