S&P Dow Jones Launches New S&P Digital Markets 50 Index: A Game-Changer for Crypto Integration?

PositiveCryptocurrency

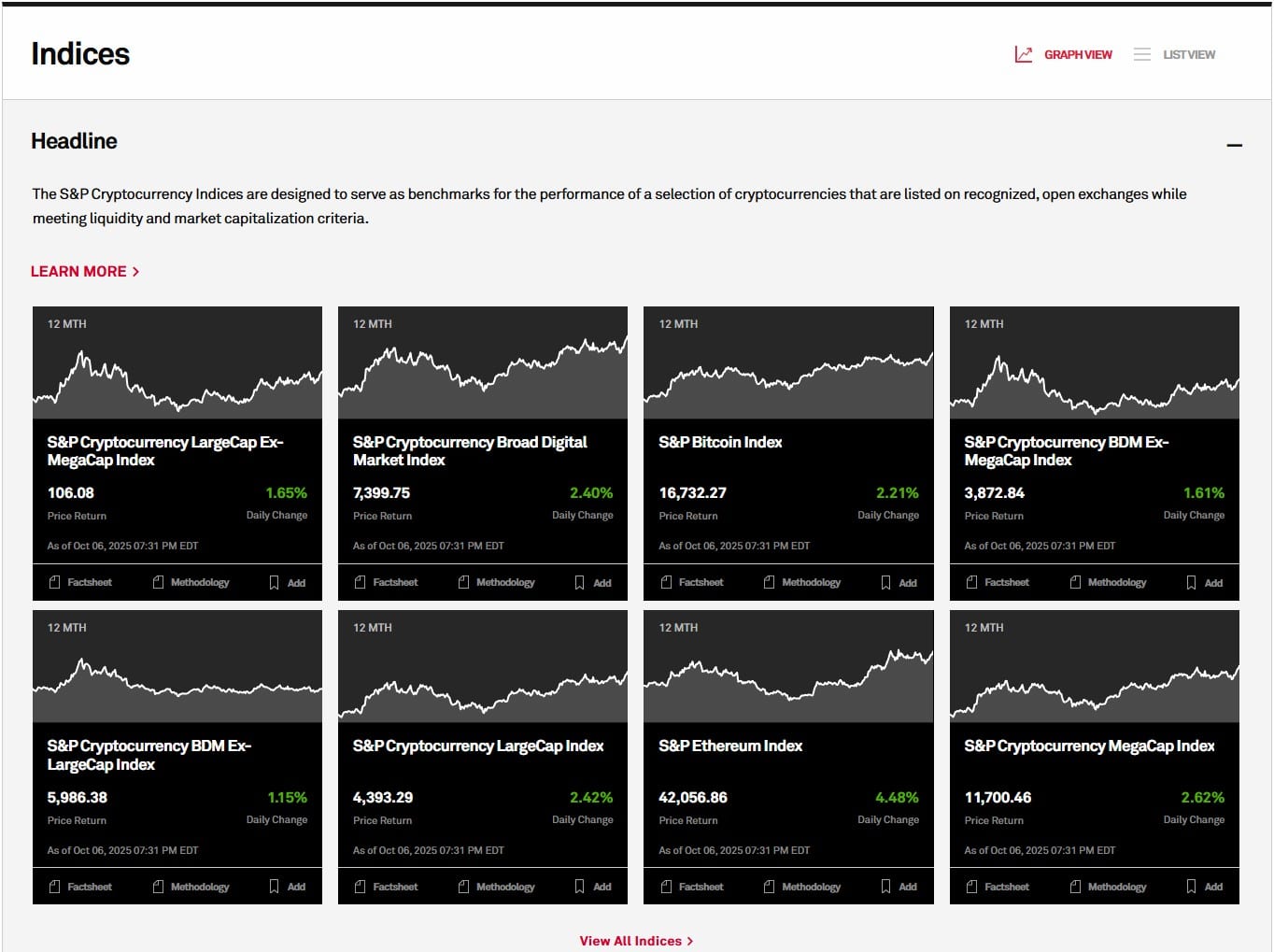

On October 7, 2025, S&P Dow Jones Indices launched the S&P Digital Markets 50 Index, a significant step towards integrating traditional finance with the world of cryptocurrencies. This new index aims to provide investors with a diversified way to access both major cryptocurrencies and crypto-related stocks, making it easier for them to navigate this evolving financial landscape. This development is crucial as it reflects the growing acceptance of digital assets in mainstream finance, potentially attracting more investors to the crypto market.

— Curated by the World Pulse Now AI Editorial System