Bitmine Buys 44,036 Ethereum Worth $166M During Market Dip – Details

NeutralCryptocurrency

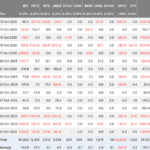

Bitmine has made a significant move by purchasing 44,036 Ethereum worth $166 million during a market dip, highlighting the ongoing volatility in the cryptocurrency space. As Ethereum struggles to stay above the $4,000 mark, this acquisition could signal confidence from investors despite the recent sell-off. The market has been under pressure, and analysts are watching closely to see if buyers can stabilize prices and prevent further declines. This situation is crucial as it reflects broader trends in the crypto market and investor sentiment.

— Curated by the World Pulse Now AI Editorial System