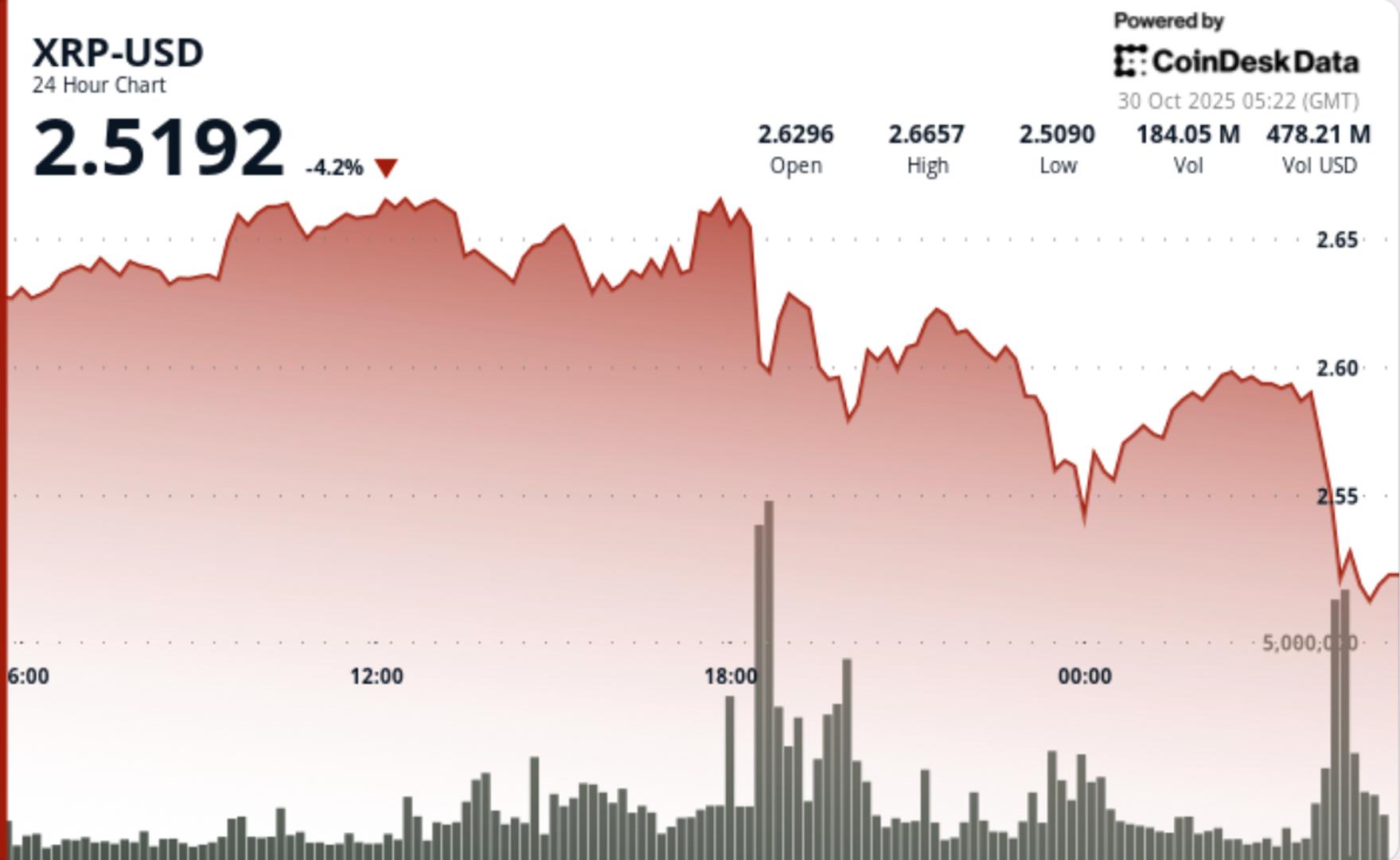

Is XRP Headed For A 16% Drop? Signal Flashes Familiar Warning

NegativeCryptocurrency

Crypto analyst Ali Martinez has raised concerns about XRP's potential for a 16% drop, citing a new sell signal from the Tom DeMark Sequential Indicator. This tool has proven reliable in predicting XRP's trend reversals recently, making this warning significant for investors. As the cryptocurrency market remains volatile, understanding these signals can help traders make informed decisions.

— Curated by the World Pulse Now AI Editorial System