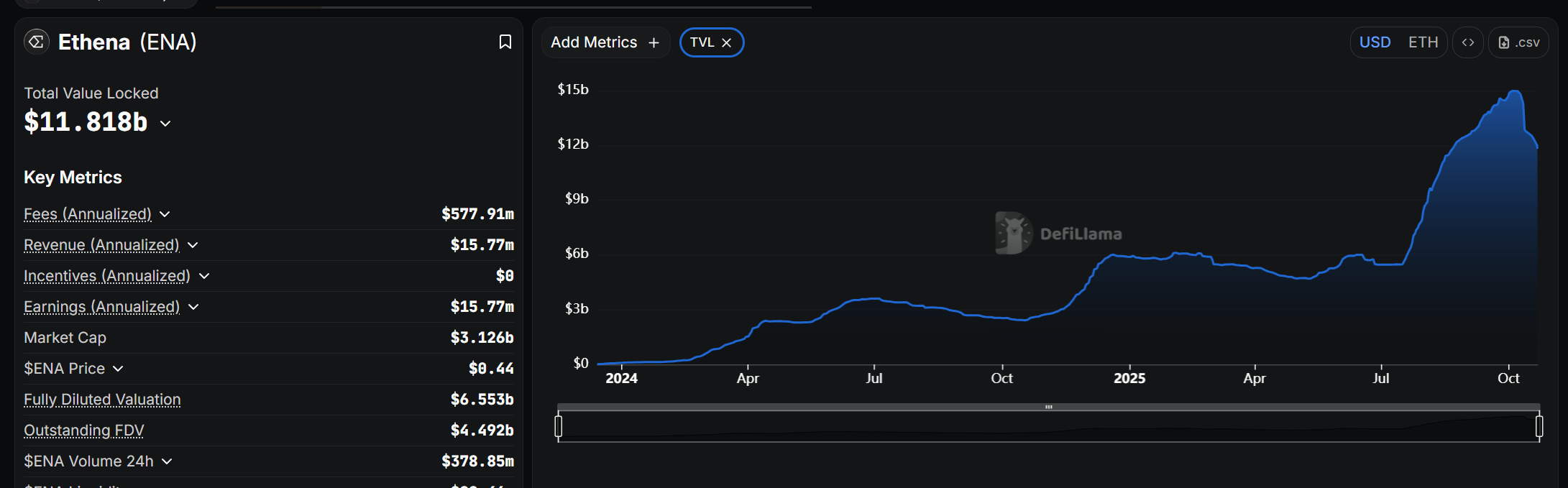

Ethena Crypto is Expanding Its Team: Could You Be The Future of USDe?

PositiveCryptocurrency

Ethena Crypto is making waves by expanding its team, signaling a promising future for USDe, the third-largest stablecoin. Co-founder Guy Young shared the news on X, highlighting the company's growth after a quiet period. This expansion could lead to innovative developments in the crypto space, making it an exciting time for both the team and investors.

— Curated by the World Pulse Now AI Editorial System