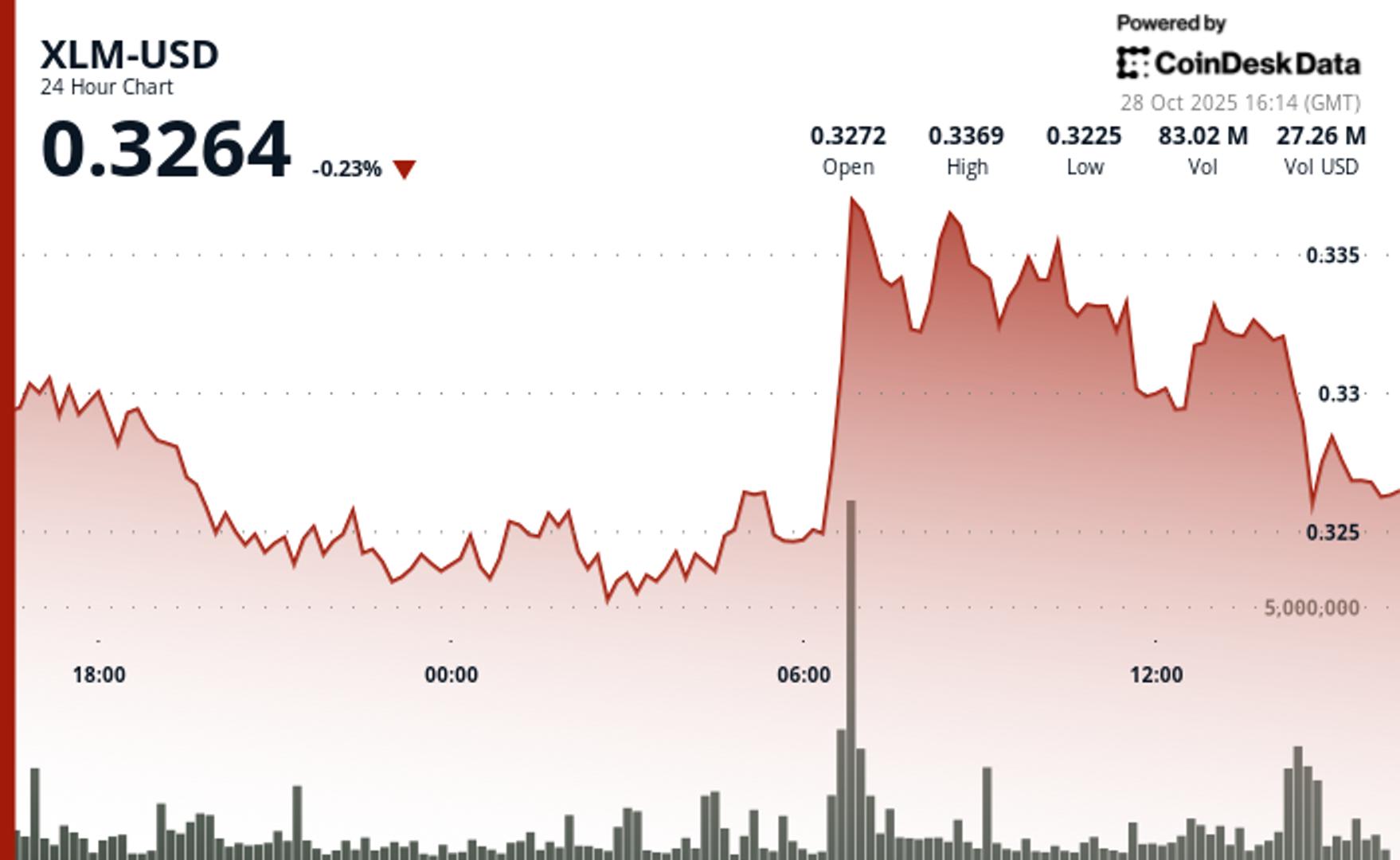

XLM Gains 2.3% to $0.3314 as Payment Networks Drive Institutional Interest

PositiveCryptocurrency

XLM has seen a 2.3% increase in value, reaching $0.3314, as interest from institutional investors in blockchain-based payment networks rises. This surge is particularly notable during the European trading session, indicating a growing confidence in digital currencies. The upward trend not only reflects the potential of XLM but also highlights a broader shift towards adopting blockchain technology in financial transactions.

— Curated by the World Pulse Now AI Editorial System