TRUMP token issuer exploring deal to buy Republic’s US operations

PositiveCryptocurrency

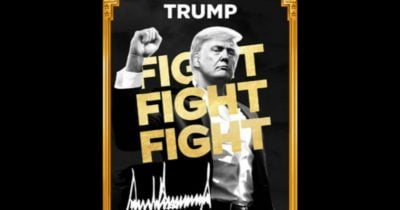

Fight Fight Fight LLC, the issuer of the TRUMP token, is considering acquiring Republic's US operations. This move could diversify their business model and significantly impact the crowdfunding landscape by integrating digital assets more effectively. It's an exciting development that could reshape how crowdfunding operates in the digital age.

— Curated by the World Pulse Now AI Editorial System