Bitcoin and Ethereum Price Prediction: Is BTC Losing Steam After “Uptober,” and Can ETH Lead the Next Rally?

NeutralCryptocurrency

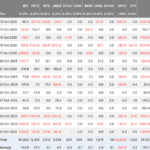

Bitcoin's price is showing signs of losing momentum after a lackluster October, often referred to as 'Uptober.' As we enter November, Bitcoin was trading around $110,000, but market sentiment remains cautious following a tough session on Wall Street. This situation raises questions about whether Ethereum can lead the next rally in the cryptocurrency market. Understanding these trends is crucial for investors looking to navigate the volatile landscape of digital currencies.

— Curated by the World Pulse Now AI Editorial System