Expert Says China’s New Gold Hubs Signal a Time-Zone Power Shift

PositiveCryptocurrency

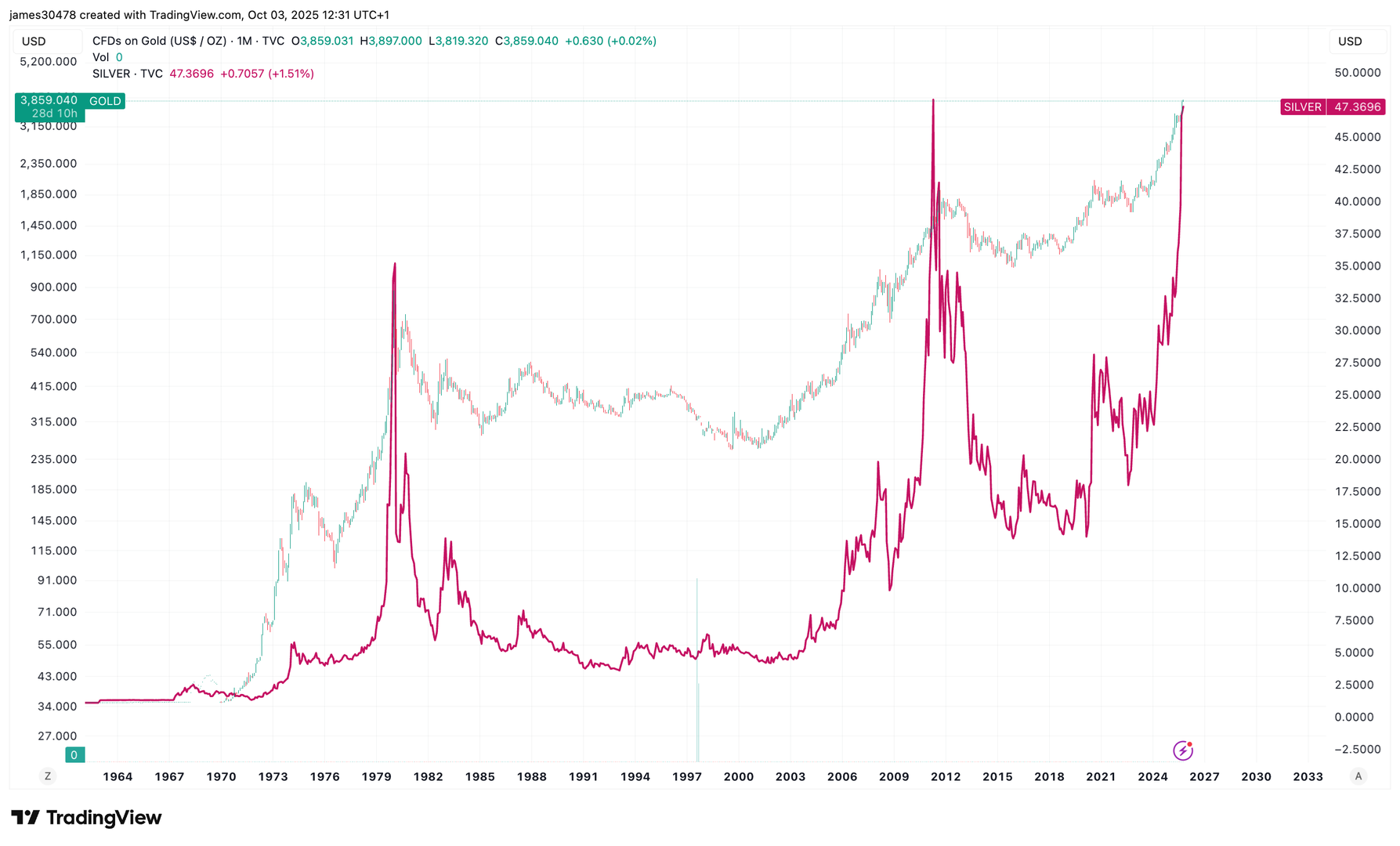

An expert has highlighted that China's establishment of new gold hubs could indicate a significant shift in global power dynamics, particularly in relation to time zones. This development is crucial as it may enhance China's influence in the gold market and reshape international trading patterns, potentially affecting economies worldwide.

— Curated by the World Pulse Now AI Editorial System