Elon Musk Reignites Floki Frenzy, Can FLOKI Hold Gains as Crypto Market Falls 3%?

PositiveCryptocurrency

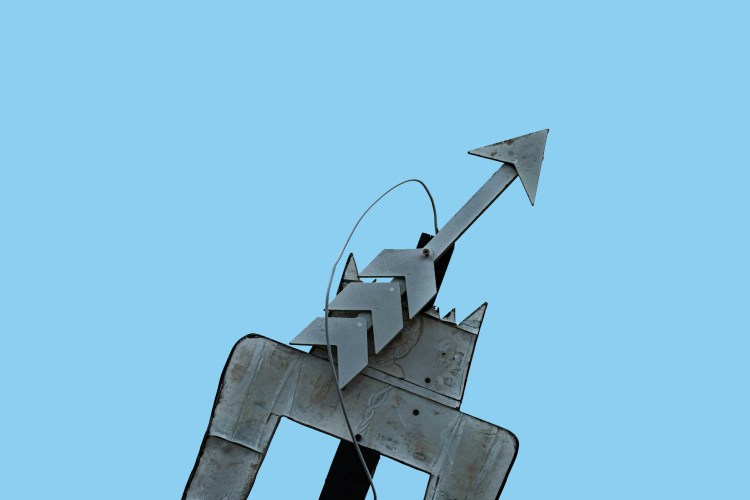

Elon Musk has sparked renewed interest in the meme-coin FLOKI, which saw a remarkable 6% increase this week after he shared an AI-generated video of his Shiba Inu, Floki, at a CEO desk. This surge comes despite a 3% decline in the broader crypto market. FLOKI's price soared nearly 30% within hours, with trading volume skyrocketing by up to 817%, reaching around $660 million. This excitement highlights the volatile nature of meme-coins and their ability to capture investor attention, especially when linked to high-profile figures like Musk.

— Curated by the World Pulse Now AI Editorial System