XRP Final Test: Will Wave 4 End With One More Shakeout Before Liftoff?

NeutralCryptocurrency

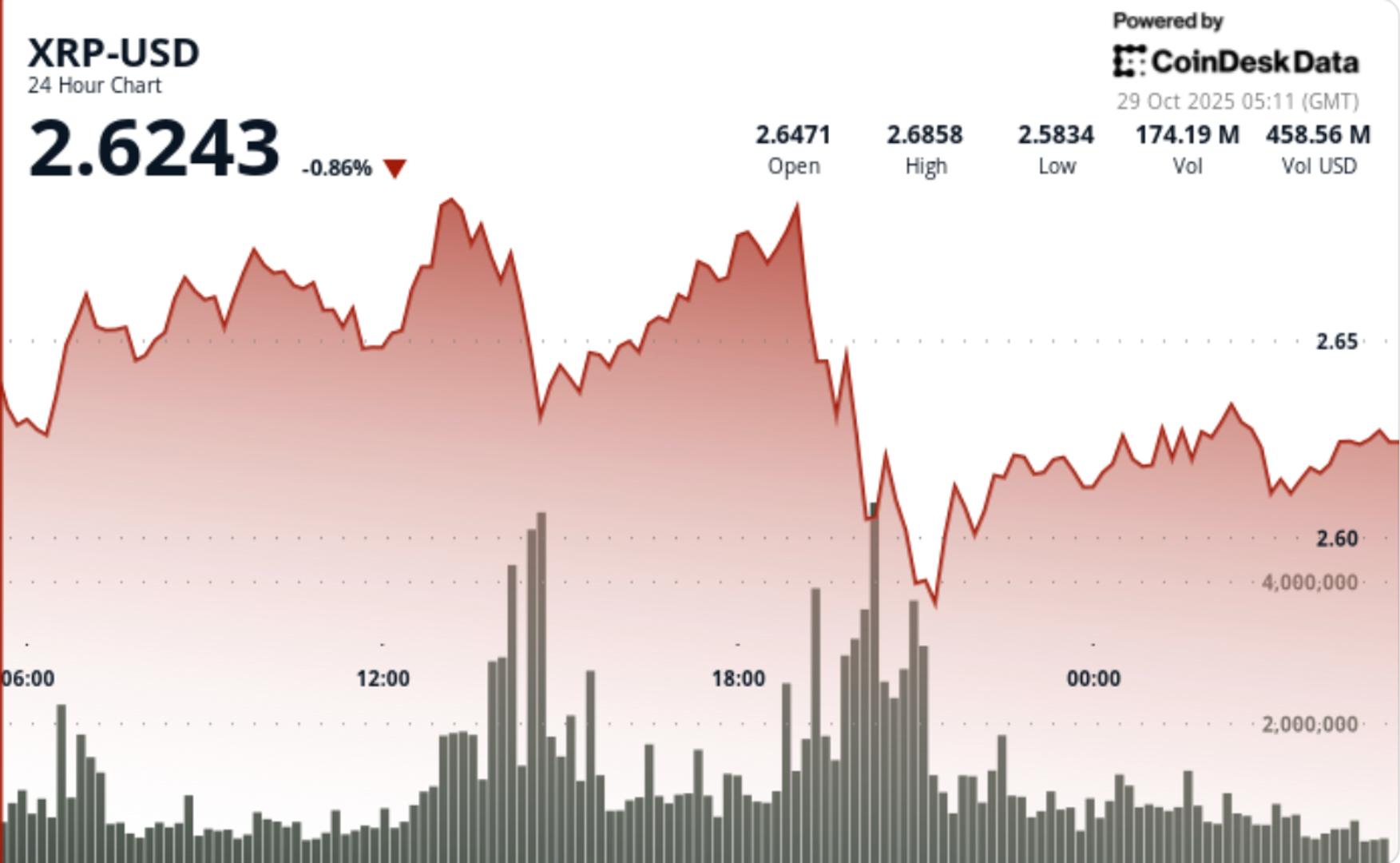

XRP is currently at a pivotal resistance level, prompting traders to speculate whether a final dip will occur before a significant breakout. As it continues to fluctuate within a critical range, analysts from CasiTrades emphasize that this moment is crucial for determining the next steps for XRP. Understanding these movements is essential for investors looking to navigate the volatile cryptocurrency market.

— Curated by the World Pulse Now AI Editorial System