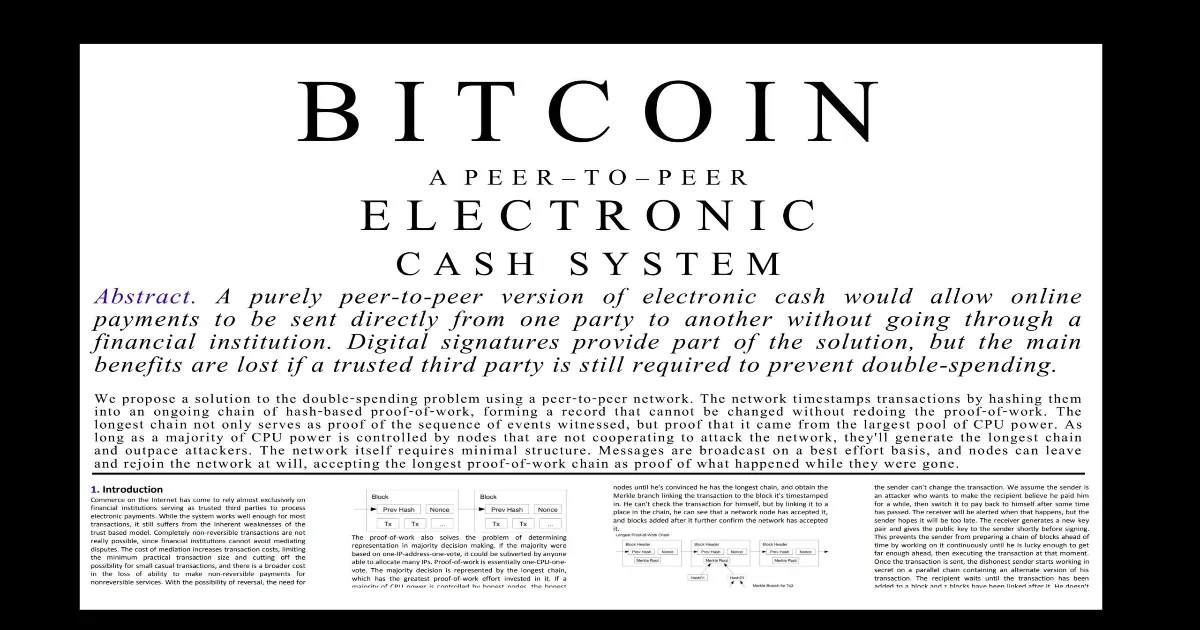

Bitcoin: The Dawn of a New Monetary Era

PositiveCryptocurrency

Seventeen years after its inception, Bitcoin has transformed from a mere cryptographic experiment into a significant global movement, as highlighted by Tony Yazbeck, co-founder of The Bitcoin Way. This evolution is crucial as it signifies a shift in how we perceive and utilize money, potentially reshaping financial systems worldwide.

— Curated by the World Pulse Now AI Editorial System