Tokenization Meets AI: Securitize Expands RWA Access Through MCP Server

PositiveCryptocurrency

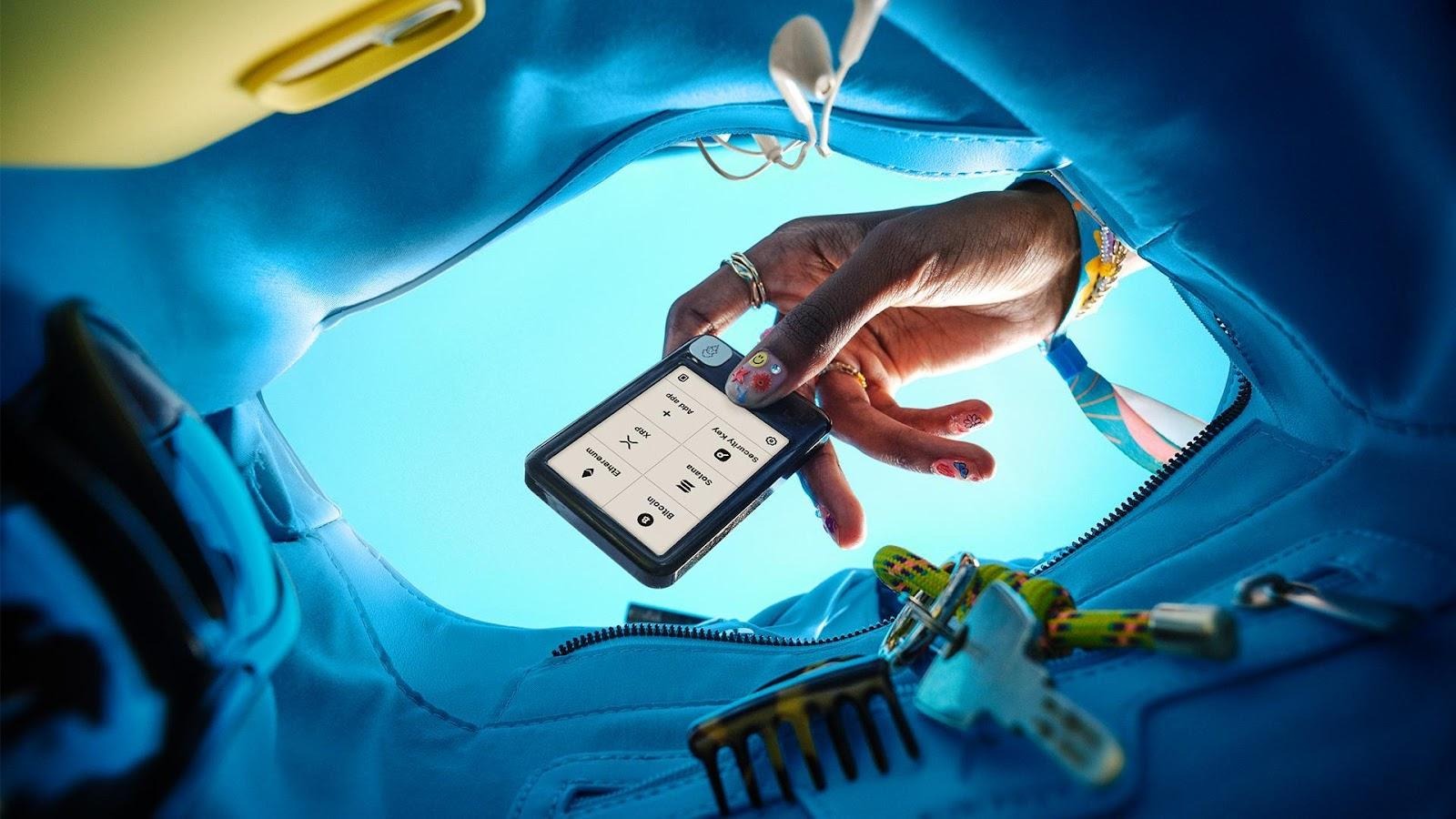

Securitize is making waves in the financial sector by expanding access to real-world assets (RWA) through its innovative MCP server, which leverages artificial intelligence. This development is significant as it opens new avenues for investors and enhances the efficiency of asset management, making it easier for individuals and institutions to engage with tokenized assets. As the intersection of tokenization and AI continues to evolve, Securitize's advancements could reshape how we think about asset ownership and investment.

— Curated by the World Pulse Now AI Editorial System