Warum Asiens Börsen plötzlich Angst vor Bitcoin haben – und was das für die Zukunft des Mining bedeutet

NegativeCryptocurrency

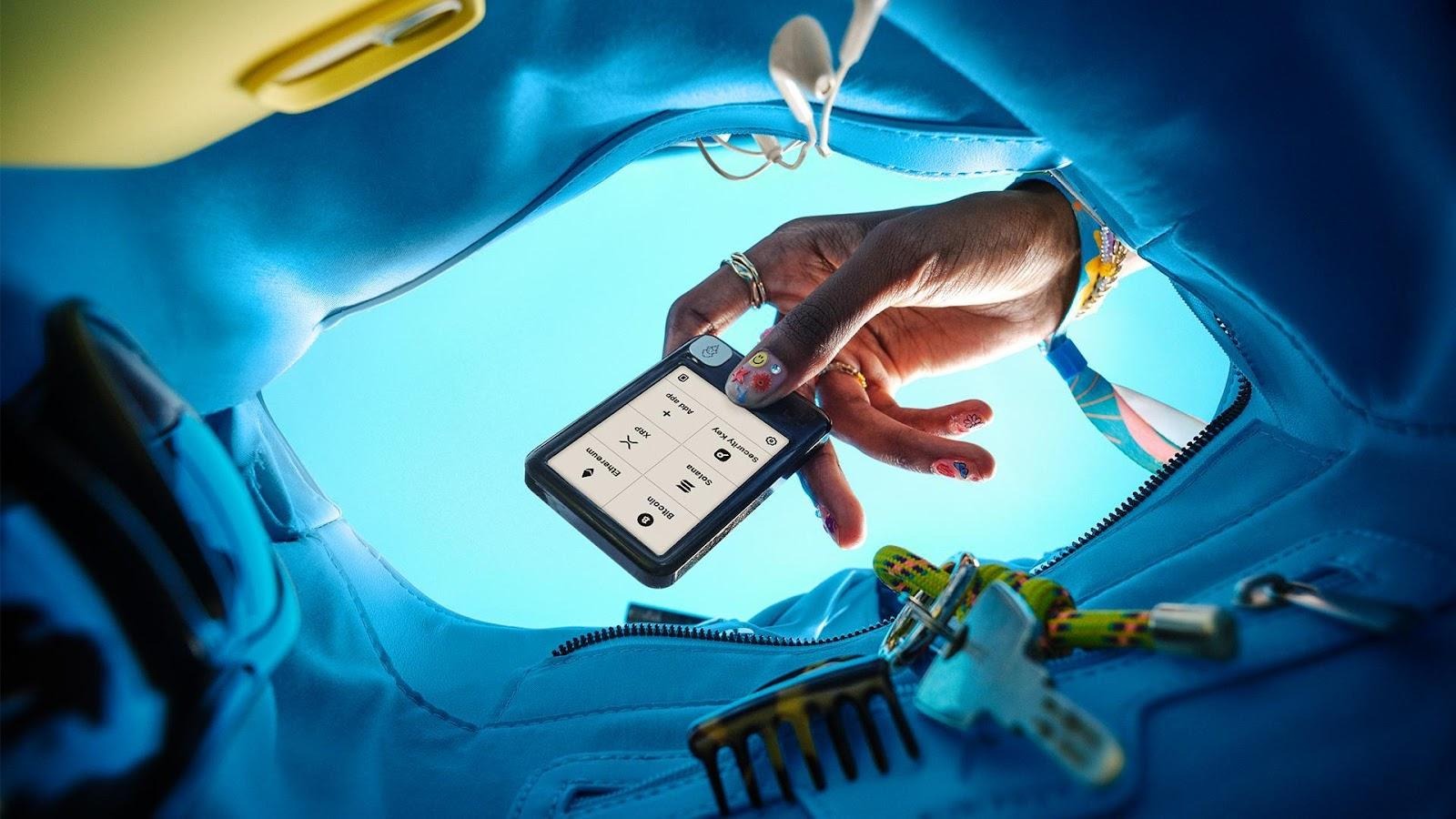

Asian markets are growing increasingly wary of Bitcoin, with firms in Hong Kong, India, and Australia facing restrictions on using the cryptocurrency in their finances. Experts warn that this could lead companies to engage in risky Bitcoin investments. As more businesses consider adding Bitcoin to their reserves, the tightening regulations could stifle innovation and investment in the digital currency sector, raising concerns about the future of Bitcoin mining and its role in the economy.

— Curated by the World Pulse Now AI Editorial System