Core PCE Fails to Dent BTC USD Price: Grok Predicts Bitcoin Monthly Close

NeutralCryptocurrency

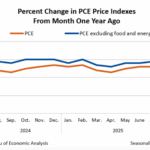

Bitcoin's price has stabilized around $109,000 following the release of US inflation data that met expectations. This stability comes as Elon Musk's Grok AI predicts that Bitcoin will likely close the month at similar levels. The core personal consumption expenditures (PCE) index, which is the Federal Reserve's preferred measure of inflation, did not significantly impact Bitcoin's value, indicating a resilient market amidst economic fluctuations.

— Curated by the World Pulse Now AI Editorial System