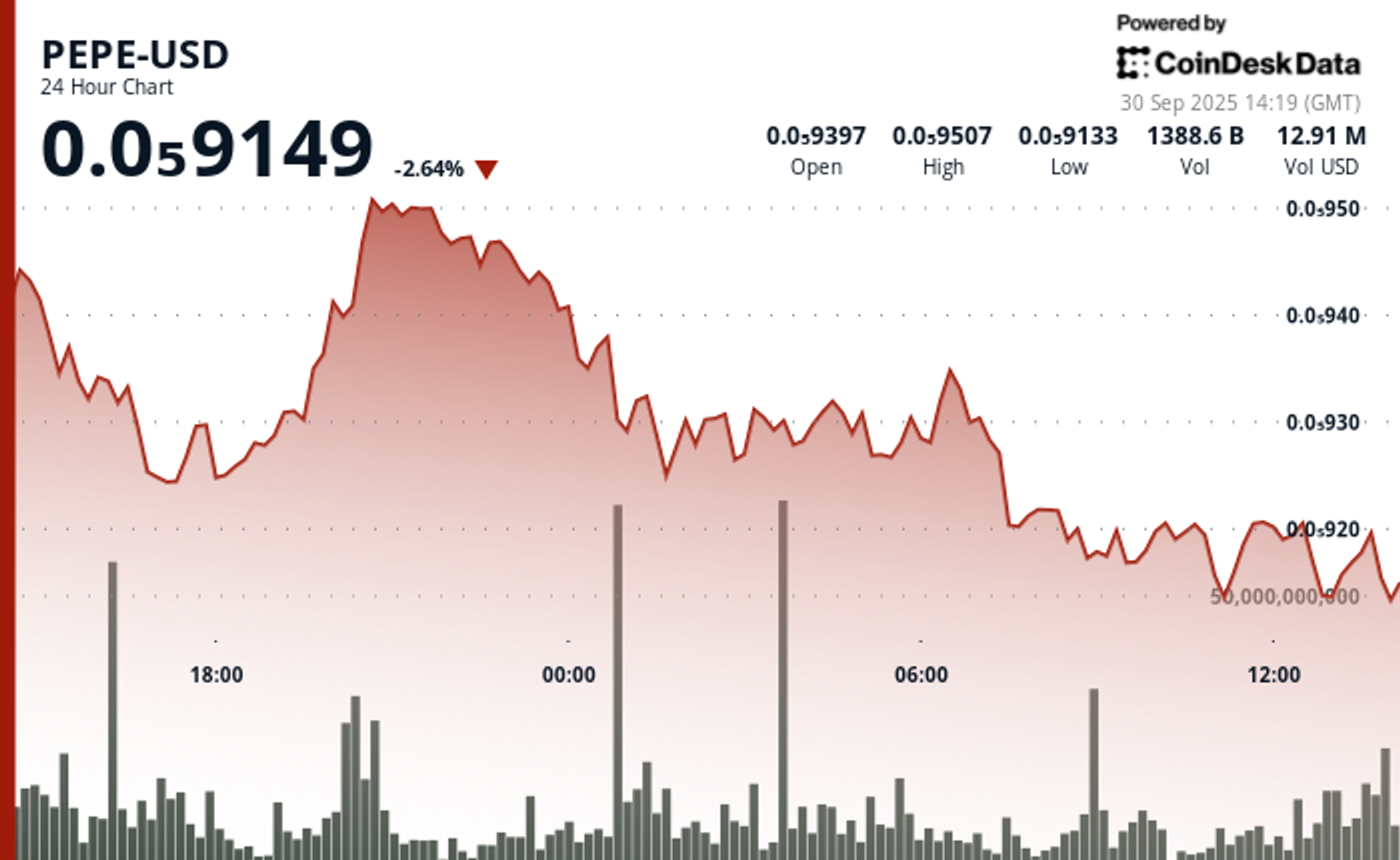

PEPE Falls 2.6% After Failing to Breach Resistance Levels

NegativeCryptocurrency

PEPE has experienced a 2.6% decline after failing to break through key resistance levels, which is significant for investors watching market trends. This drop highlights the challenges the cryptocurrency faces in gaining momentum, raising concerns about its future performance and investor confidence.

— Curated by the World Pulse Now AI Editorial System