U.S. Set to Lock In $14 Billion in Bitcoin as Part of Strategic Reserve

PositiveCryptocurrency

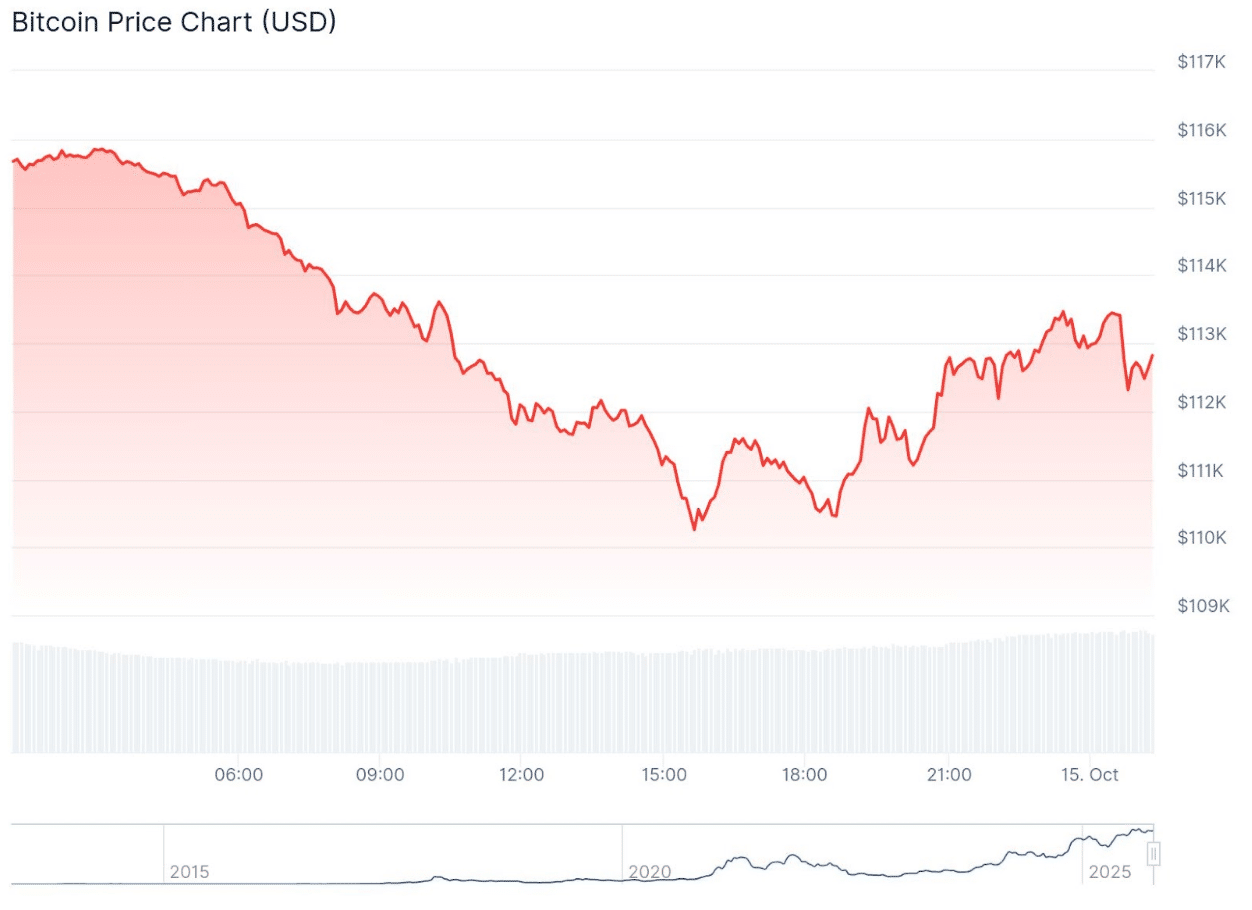

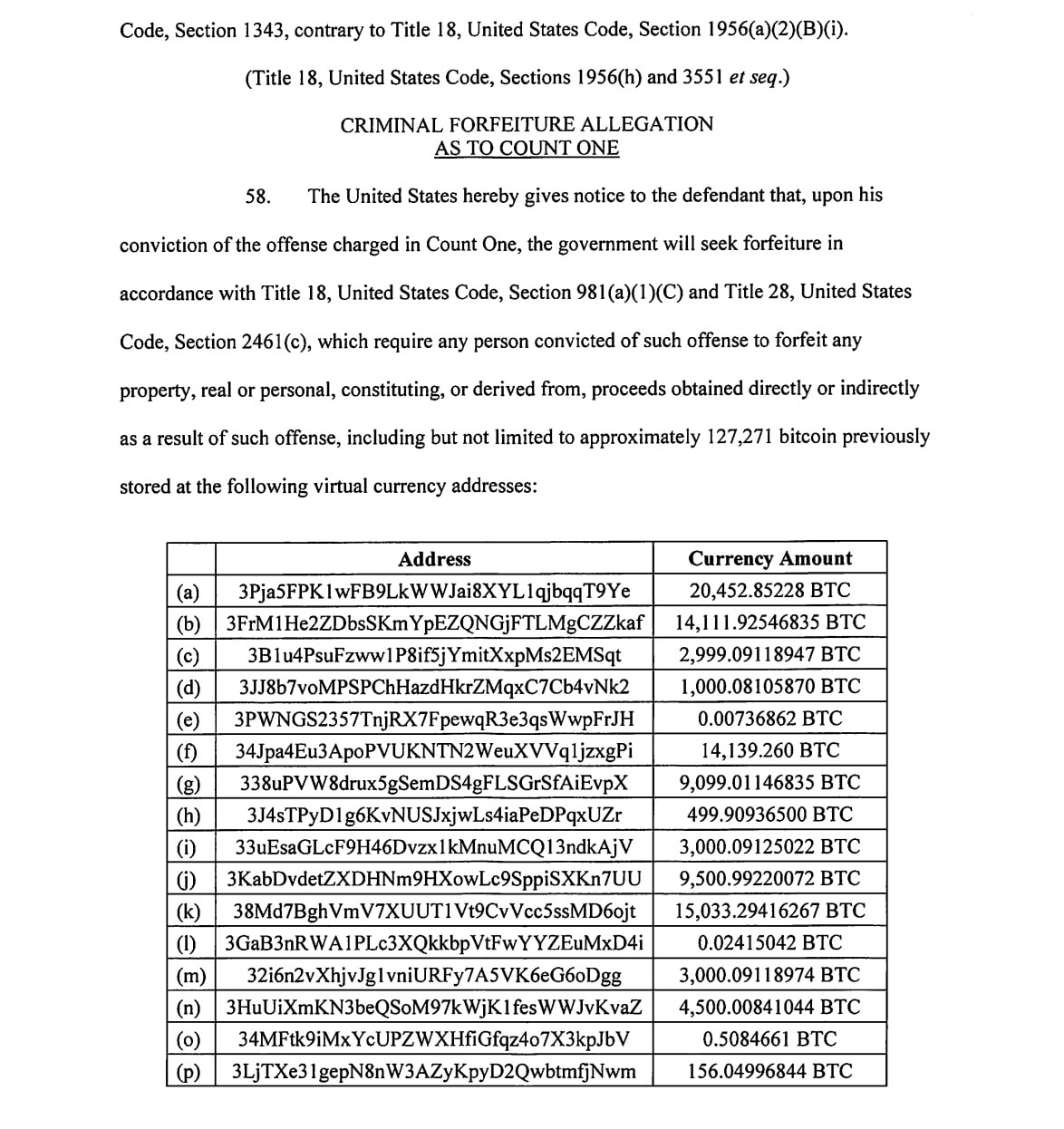

The U.S. government is set to secure approximately 127,271 bitcoins, valued at around $14.2 billion, as part of its new Strategic Bitcoin Reserve. This move follows a significant operation in collaboration with UK authorities, where these bitcoins were seized from a major crypto fraud scheme led by Chen Zhi, a Chinese national linked to the Cambodia-based Prince. This development not only highlights the government's proactive stance on cryptocurrency regulation but also underscores the ongoing efforts to combat financial fraud in the digital space.

— Curated by the World Pulse Now AI Editorial System