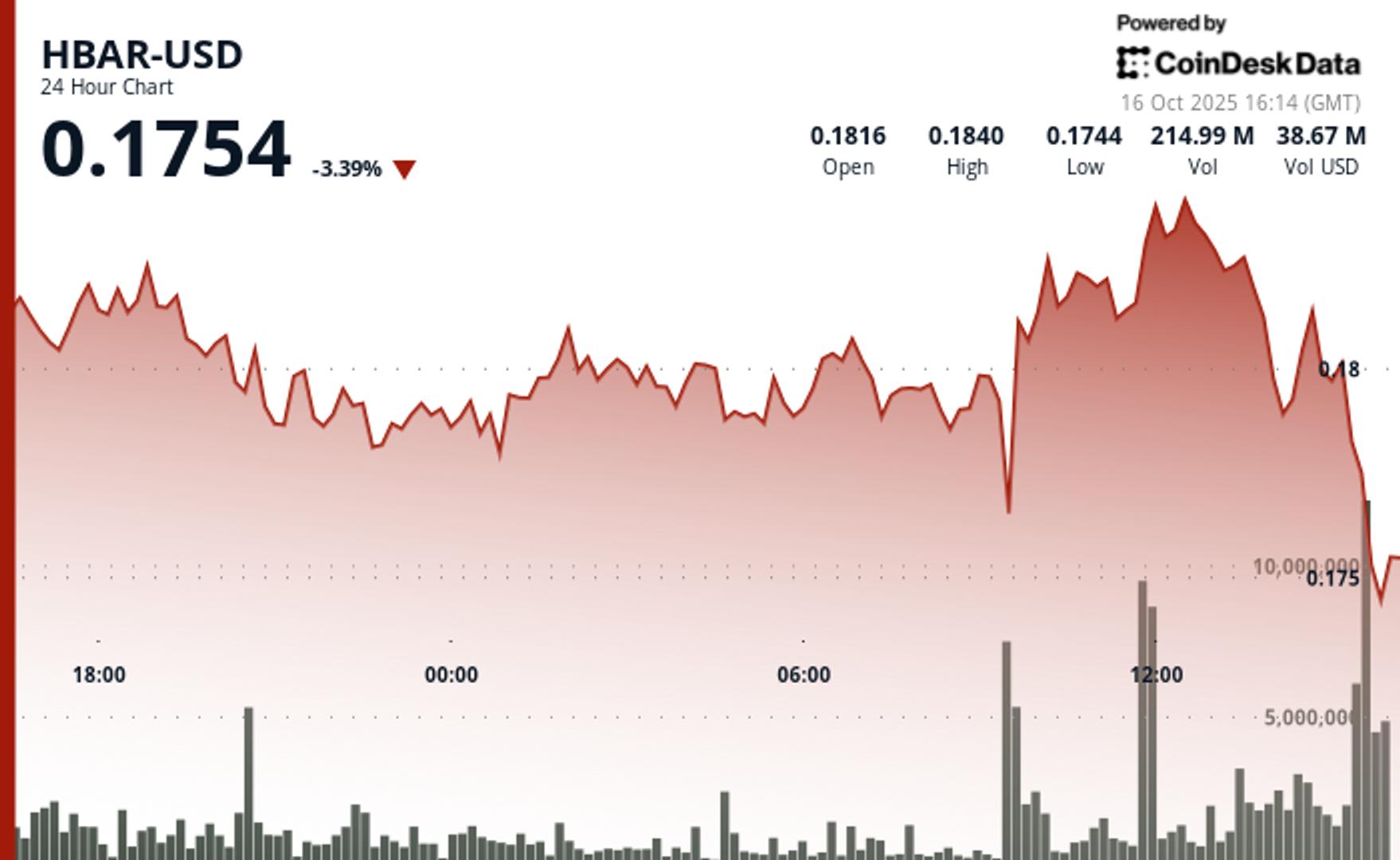

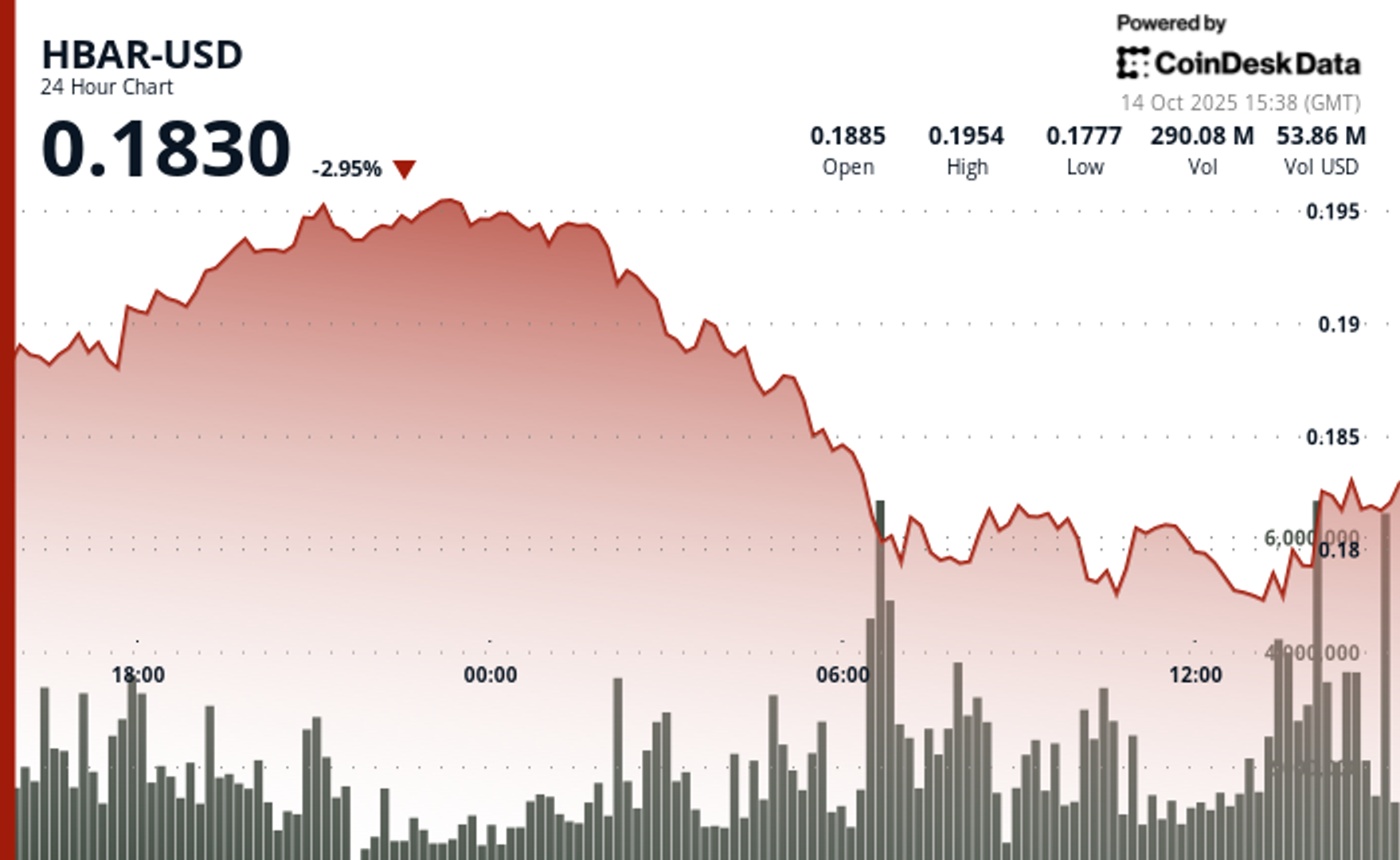

HBAR Plunges 8% After Failed Rally to $0.20 Resistance

NegativeCryptocurrency

HBAR has seen a significant drop of 8% following a failed attempt to break through the $0.20 resistance level. This dramatic reversal, marked by heavy trading volume, confirms a bearish trend in the cryptocurrency market. Such fluctuations are crucial for investors to monitor, as they can indicate broader market sentiments and potential future movements.

— Curated by the World Pulse Now AI Editorial System