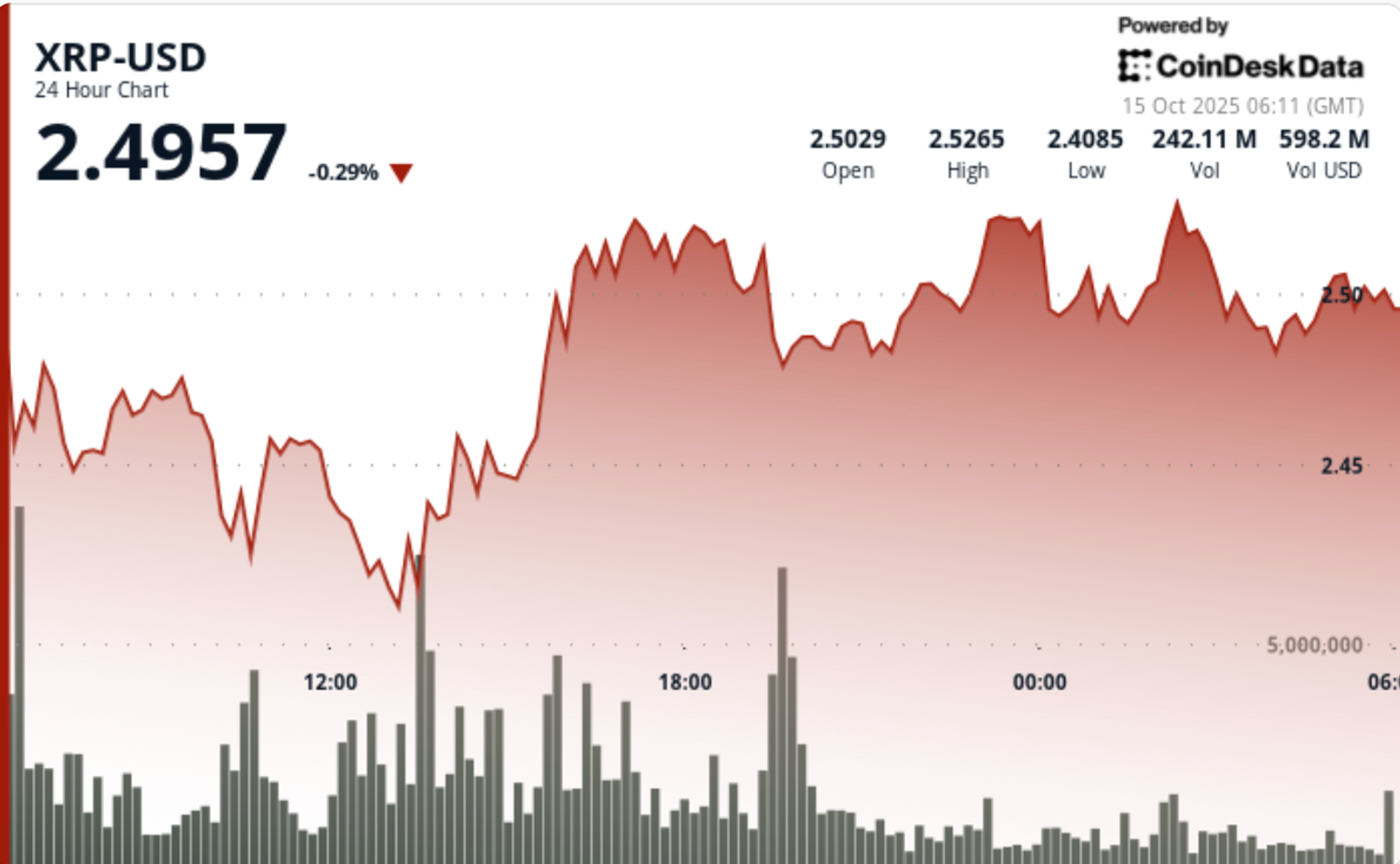

Best Altcoins to Buy as Historic Altseason Signal Resurfaces

PositiveCryptocurrency

The recent resurgence of the TOTAL3 chart suggests that we might be on the brink of another altcoin boom similar to what we saw in 2020-2021. The formation of an inverted head and shoulders pattern, along with a significant liquidation candle, indicates that a major breakout for altcoins could be just around the corner. This is exciting news for investors as the market appears to be gearing up for a strong rally, making it a potentially lucrative time to consider altcoin investments.

— Curated by the World Pulse Now AI Editorial System