TRUMP memecoin issuer seeks $200M treasury as token plunges 90%

NegativeCryptocurrency

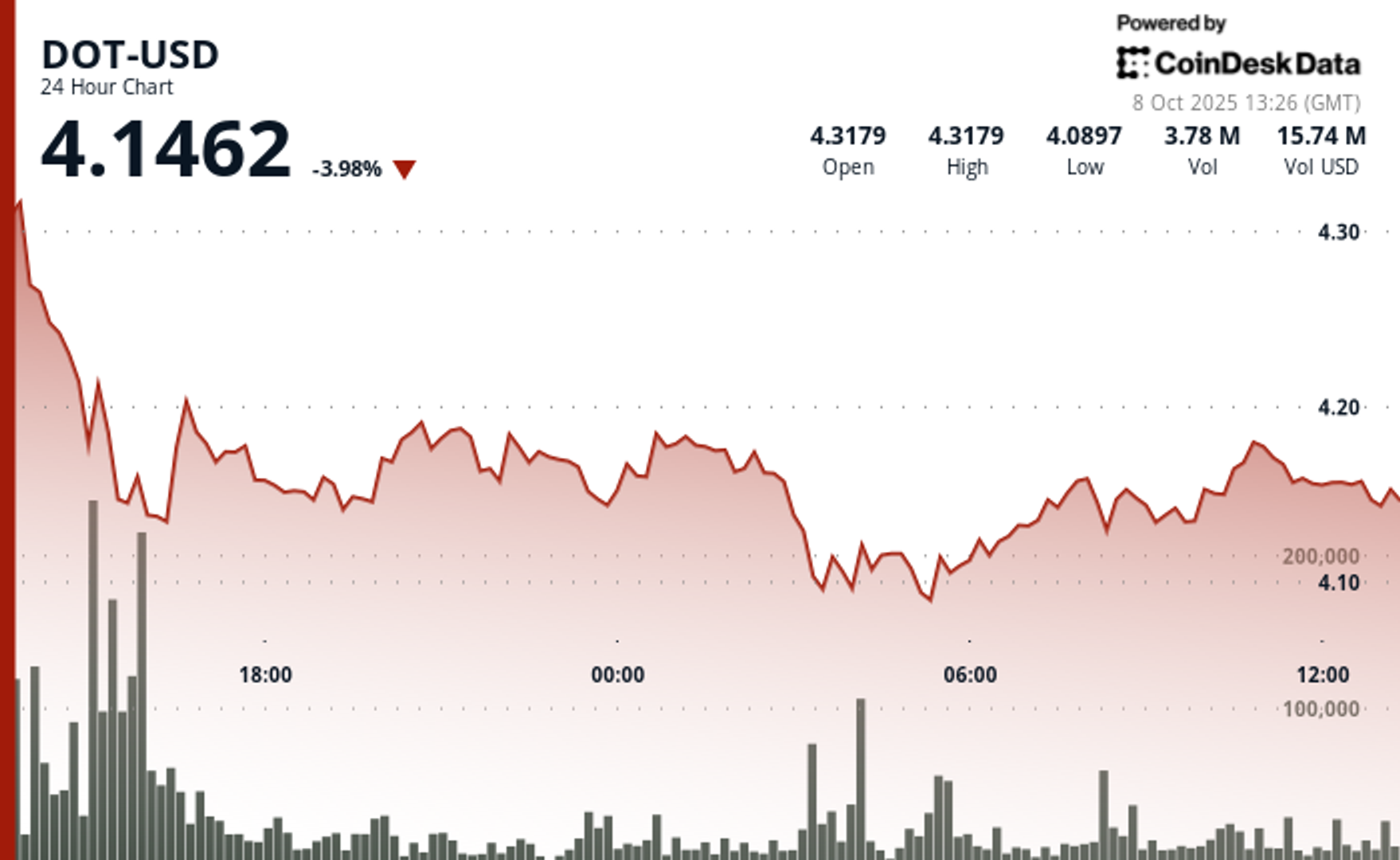

The issuer of the TRUMP memecoin is in a tough spot, seeking $200 million to create a treasury that could help stabilize its token, which has seen a staggering 90% drop in value from its peak. This situation highlights the volatility and risks associated with cryptocurrencies, especially those tied to high-profile figures like Donald Trump. Investors are watching closely to see if this move can restore confidence in the token.

— Curated by the World Pulse Now AI Editorial System