U.S. Surging in Crypto Activity Under Trump: TRM Labs Report

PositiveCryptocurrency

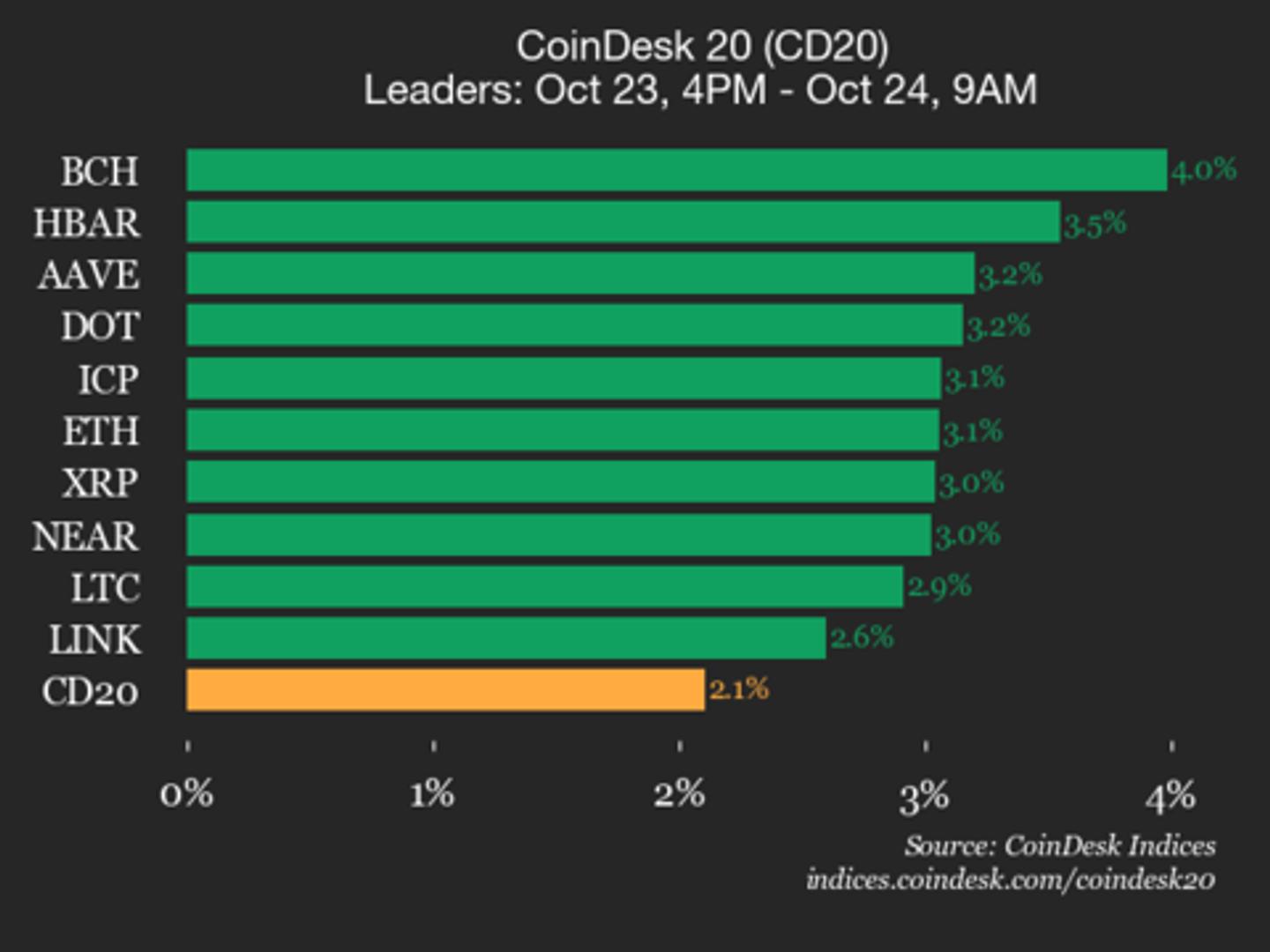

A recent report by TRM Labs highlights a significant surge in cryptocurrency activity in the U.S., with a remarkable 50% increase over just six months. This growth, while still behind India's impressive boom, reinforces the U.S.'s position as the leading global marketplace for digital assets. This trend is important as it reflects the increasing acceptance and integration of cryptocurrencies into the mainstream economy, potentially paving the way for further innovations and investments in the sector.

— Curated by the World Pulse Now AI Editorial System