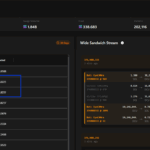

Sandwich Attacks Spiraling Out of Control on Solana, Over $3.2M Of SOL Crypto Extracted In October

NegativeCryptocurrency

In October, sandwich attacks on the Solana blockchain have surged, resulting in over $3.2 million worth of SOL cryptocurrency being extracted. This alarming trend highlights vulnerabilities in decentralized finance platforms, where users can be exploited during transactions. As more investors flock to meme coins, the risks associated with these attacks increase, raising concerns about the security of the entire ecosystem.

— Curated by the World Pulse Now AI Editorial System