Bitmine’s Tom Lee Sees Crypto Rally Into Year-End, Says S&P 500 Could Climb Another 10%

PositiveCryptocurrency

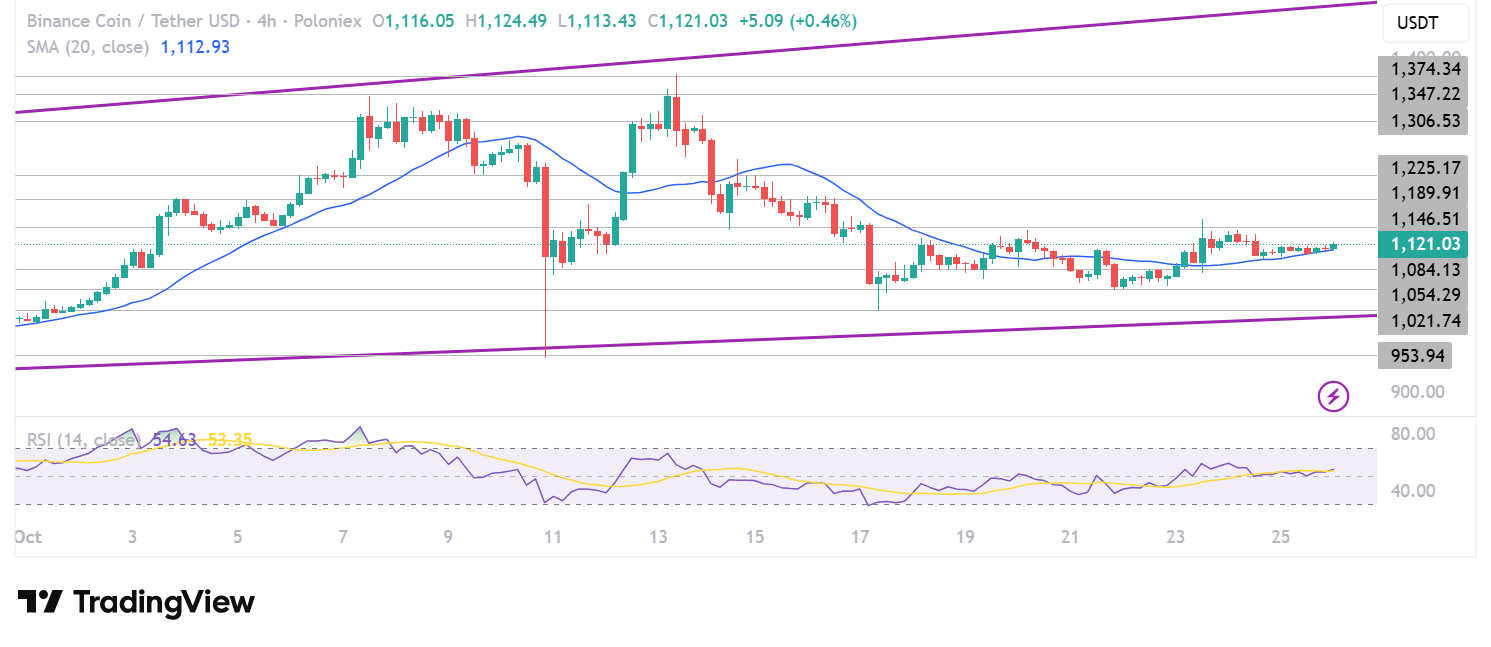

Tom Lee from Bitmine predicts a positive outlook for both the cryptocurrency market and the S&P 500 as we approach the end of the year. He believes that potential Federal Reserve interest rate cuts and a decrease in skepticism could drive U.S. stocks higher, possibly by another 10%. Additionally, he notes that the cryptocurrency market may see a rebound due to improved technical indicators and a reset in open interest. This is significant as it suggests a potential recovery in investor confidence and market performance.

— Curated by the World Pulse Now AI Editorial System