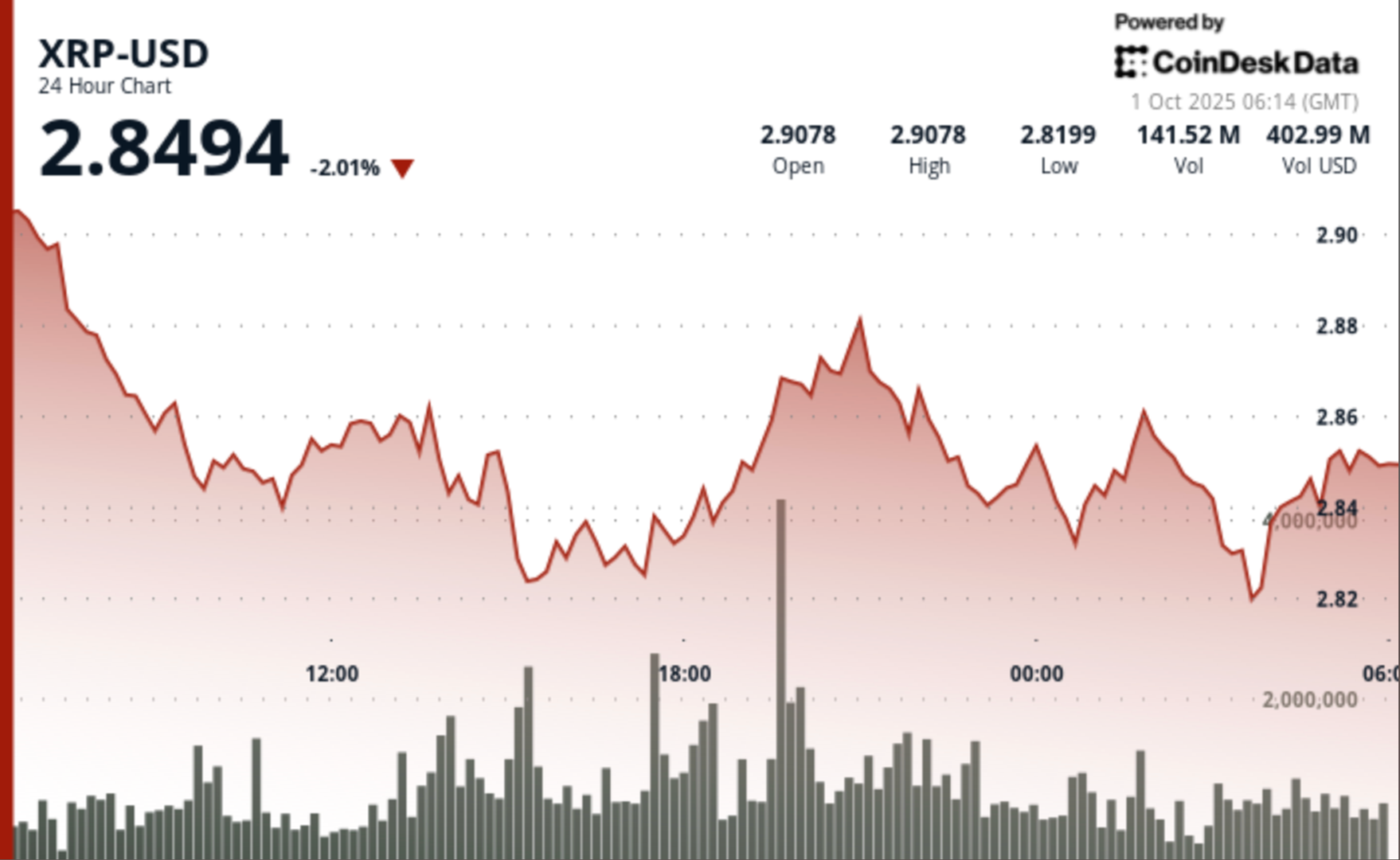

XRP Holds $2.85 After 3% Swing as ETF Hopes Dented by Profit-Taking

NeutralCryptocurrency

XRP has stabilized at $2.85 following a 3% price swing, as investor enthusiasm for exchange-traded funds (ETFs) faced a setback due to profit-taking. This situation highlights the volatility in the cryptocurrency market, where investor sentiment can shift rapidly. Understanding these dynamics is crucial for traders and investors looking to navigate the complexities of digital assets.

— Curated by the World Pulse Now AI Editorial System