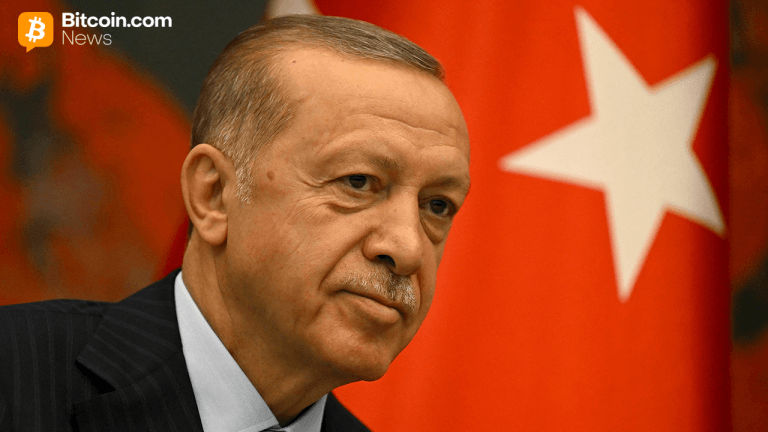

Turkey Proposes Expanded Powers for Financial Watchdog to Freeze Accounts, Blacklist Crypto Wallets

PositiveCryptocurrency

Turkey is taking significant steps to enhance its financial oversight by proposing expanded powers for its financial watchdog. This move aims to allow the authority to freeze accounts and blacklist crypto wallets, which is crucial in combating financial crimes and ensuring a safer environment for investors. By tightening regulations in the cryptocurrency space, Turkey is positioning itself to better protect its economy and citizens, reflecting a growing global trend towards stricter financial governance.

— Curated by the World Pulse Now AI Editorial System