Maple Finance stablecoins debut on Aave’s onchain lending markets

PositiveCryptocurrency

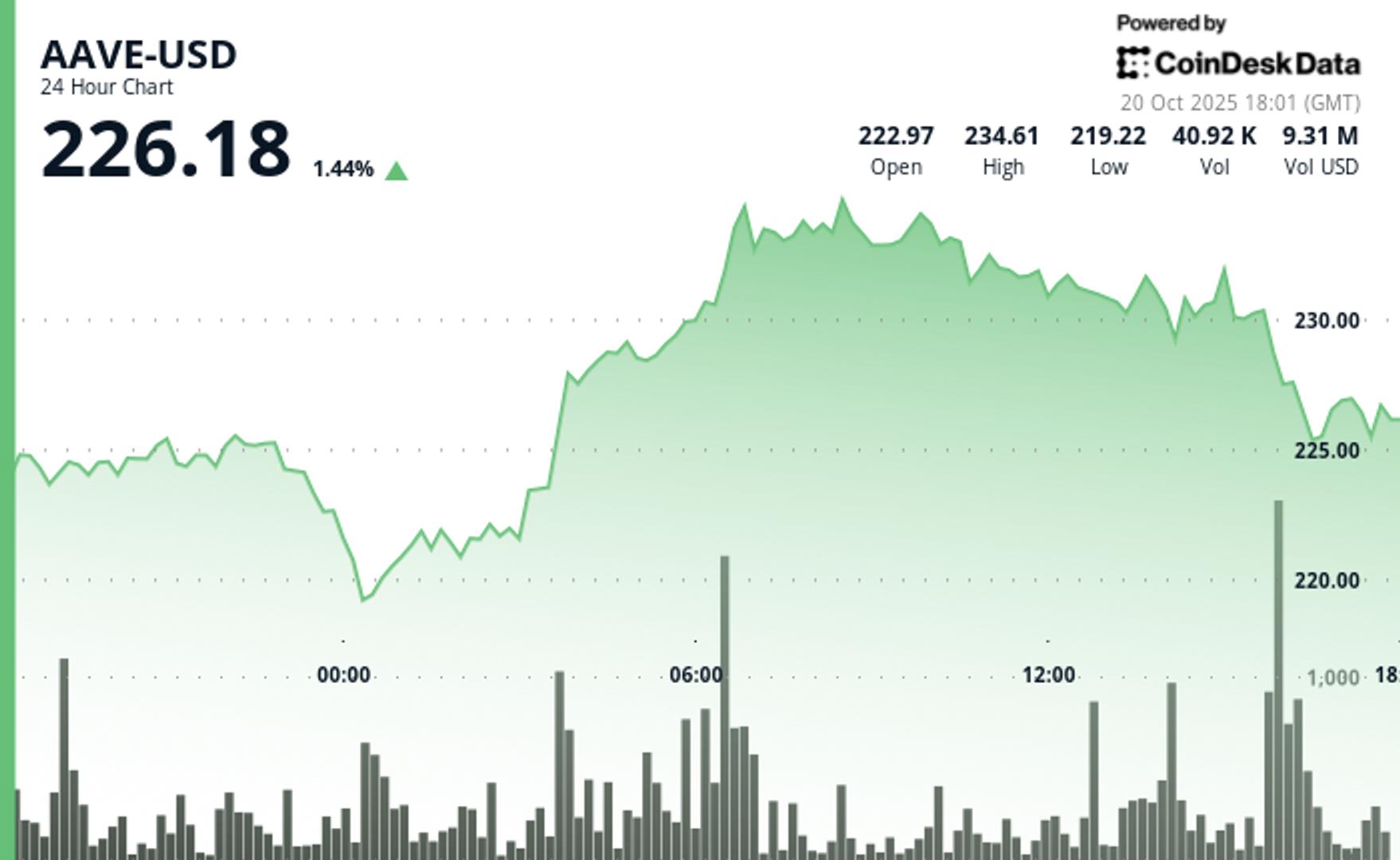

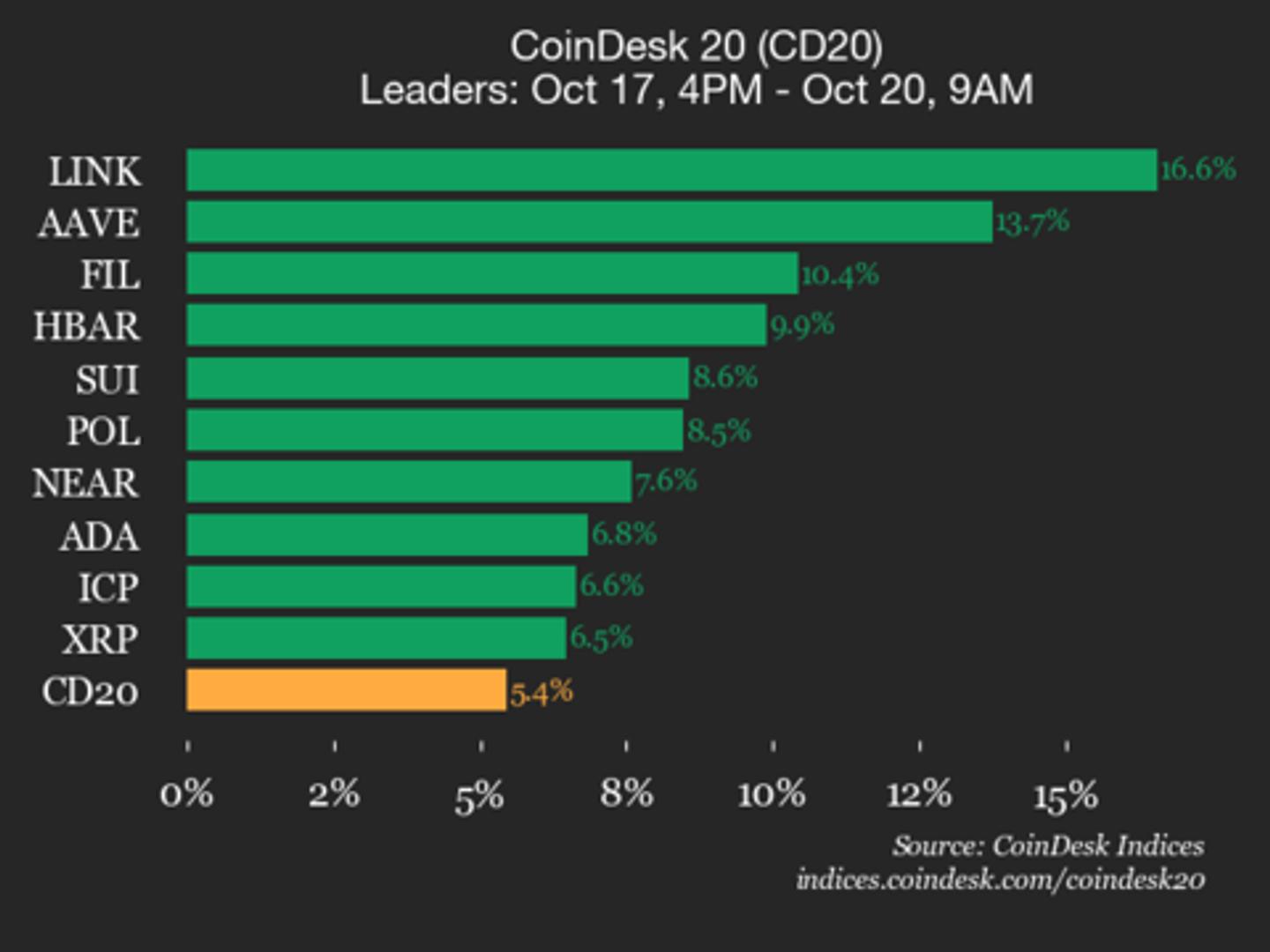

Maple Finance has launched its stablecoins on Aave's onchain lending markets, marking a significant partnership that connects Aave's liquidity with Maple's institutional credit pools. This development is exciting as it introduces yield-bearing stablecoins to Aave's platform, potentially enhancing investment opportunities for users and increasing the overall efficiency of the lending market.

— Curated by the World Pulse Now AI Editorial System