Best Crypto Presales to Buy as Pump.fun and Virtuals Protocol Suffer in Market Dump

NeutralCryptocurrency

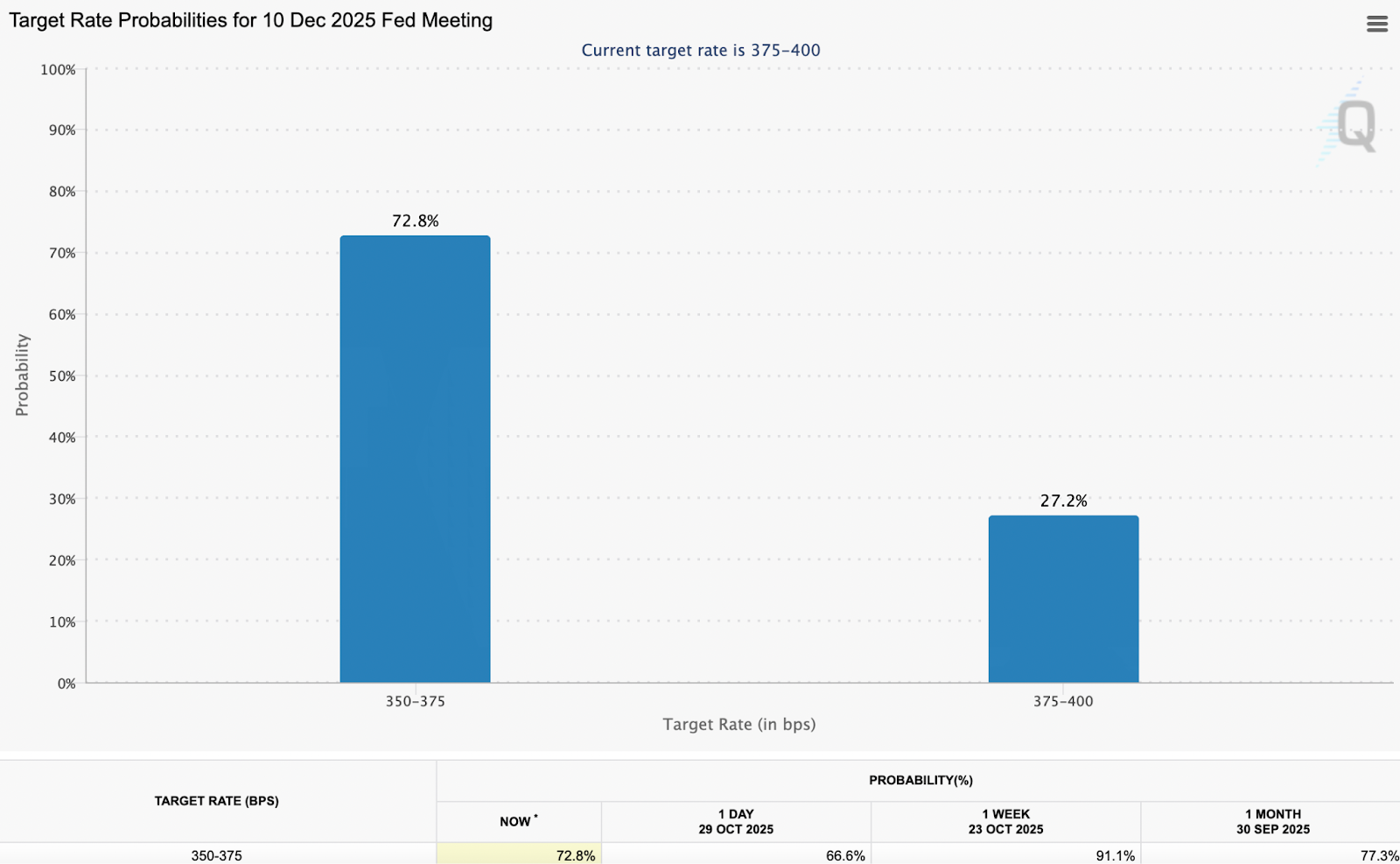

Pump.fun and Virtuals Protocol have recently experienced significant declines of nearly 20% and 15% respectively due to a market sell-off triggered by the Federal Reserve's latest rate cut. However, analysts believe that these tokens are simply consolidating and maintain a long-term bullish outlook. For investors looking for promising opportunities, presales like $BEST, $PEPENODE, and $RTX are highlighted as potential avenues for explosive growth. This situation underscores the volatility in the crypto market and the importance of strategic investment.

— Curated by the World Pulse Now AI Editorial System