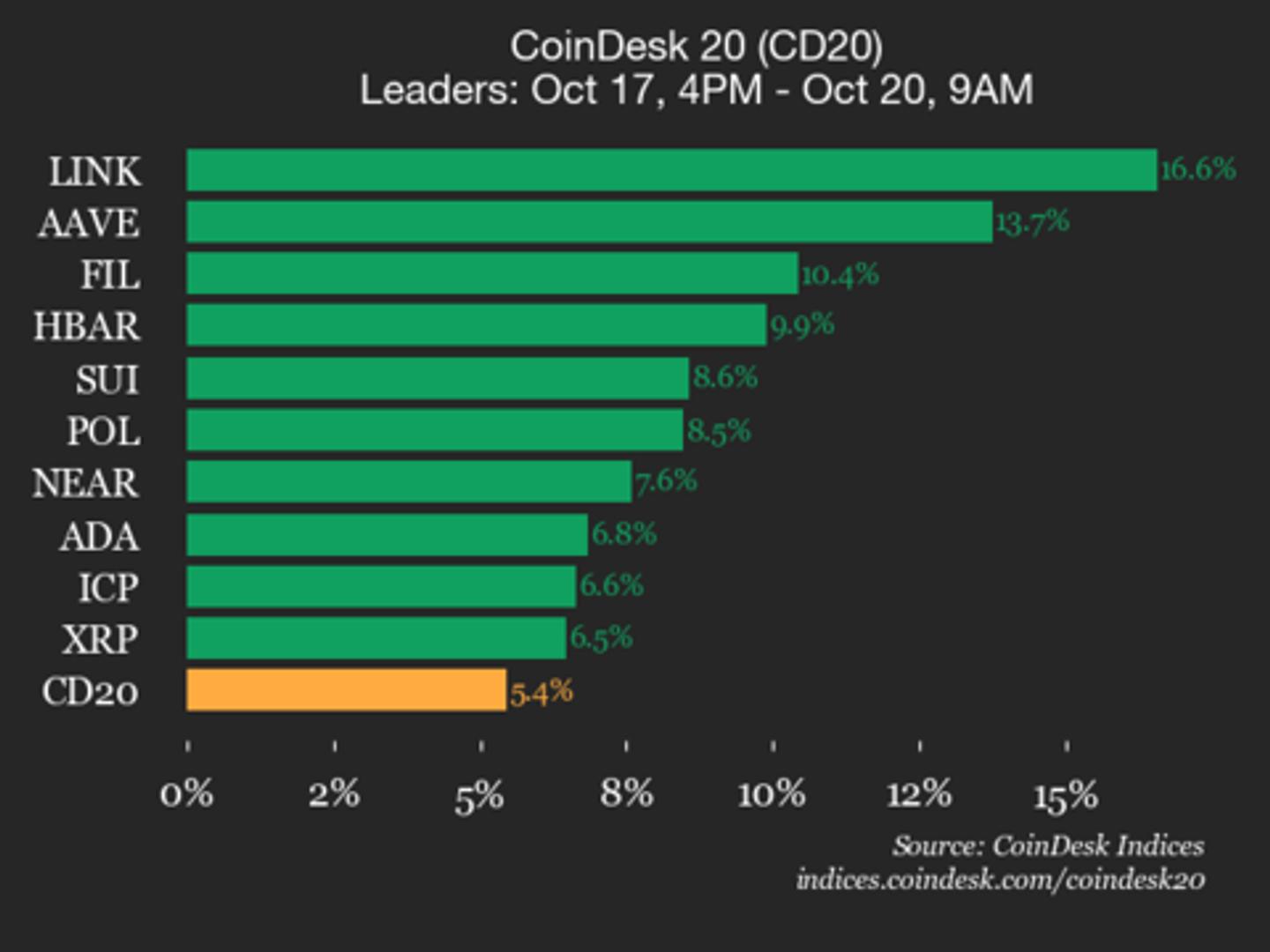

Chainlink price eyes $25 as $116.7M LINK token leaves Binance

PositiveCryptocurrency

Chainlink's price is showing signs of a bullish reversal, with predictions suggesting it could reach $25 soon. Recent on-chain data indicates that new wallets are accumulating LINK tokens, which is a positive sign for investors. This development is significant as it may signal a shift in market sentiment and provide opportunities for traders looking to capitalize on potential gains.

— Curated by the World Pulse Now AI Editorial System