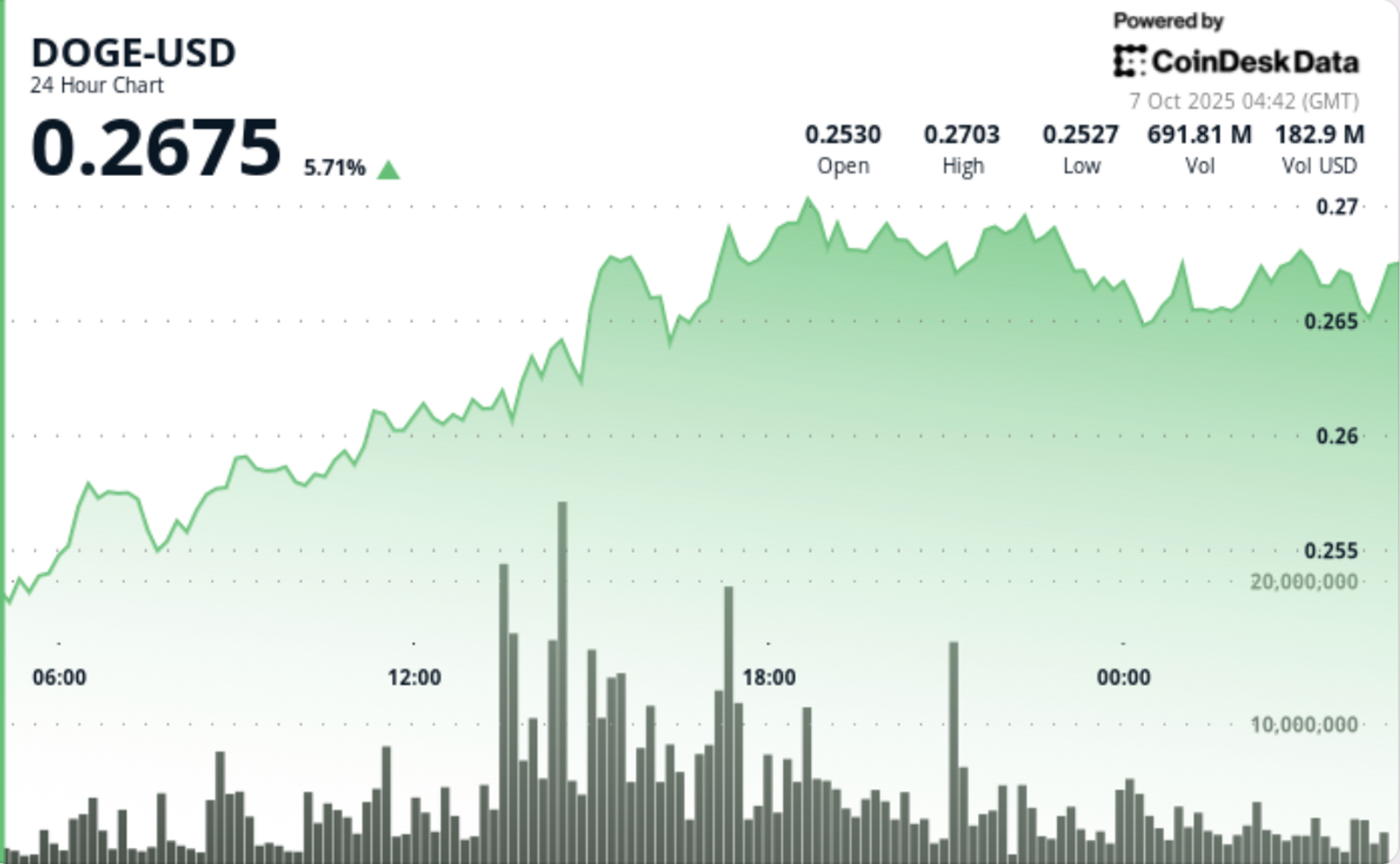

On Path to 1 Billion, Cleancore Holds 710M Dogecoin for Long-Term Strategy

PositiveCryptocurrency

Cleancore is making headlines by holding 710 million Dogecoin as part of its long-term strategy, positioning itself on the path to potentially reaching a billion. This move is significant as it reflects confidence in the cryptocurrency market and could influence other investors to consider similar strategies. With Dogecoin's popularity and volatility, Cleancore's decision may also impact the broader crypto landscape, showcasing the growing acceptance of digital currencies in investment portfolios.

— Curated by the World Pulse Now AI Editorial System