DOGE Suffers 50% Flash Crash Before Stabilizing Near $0.19

NegativeCryptocurrency

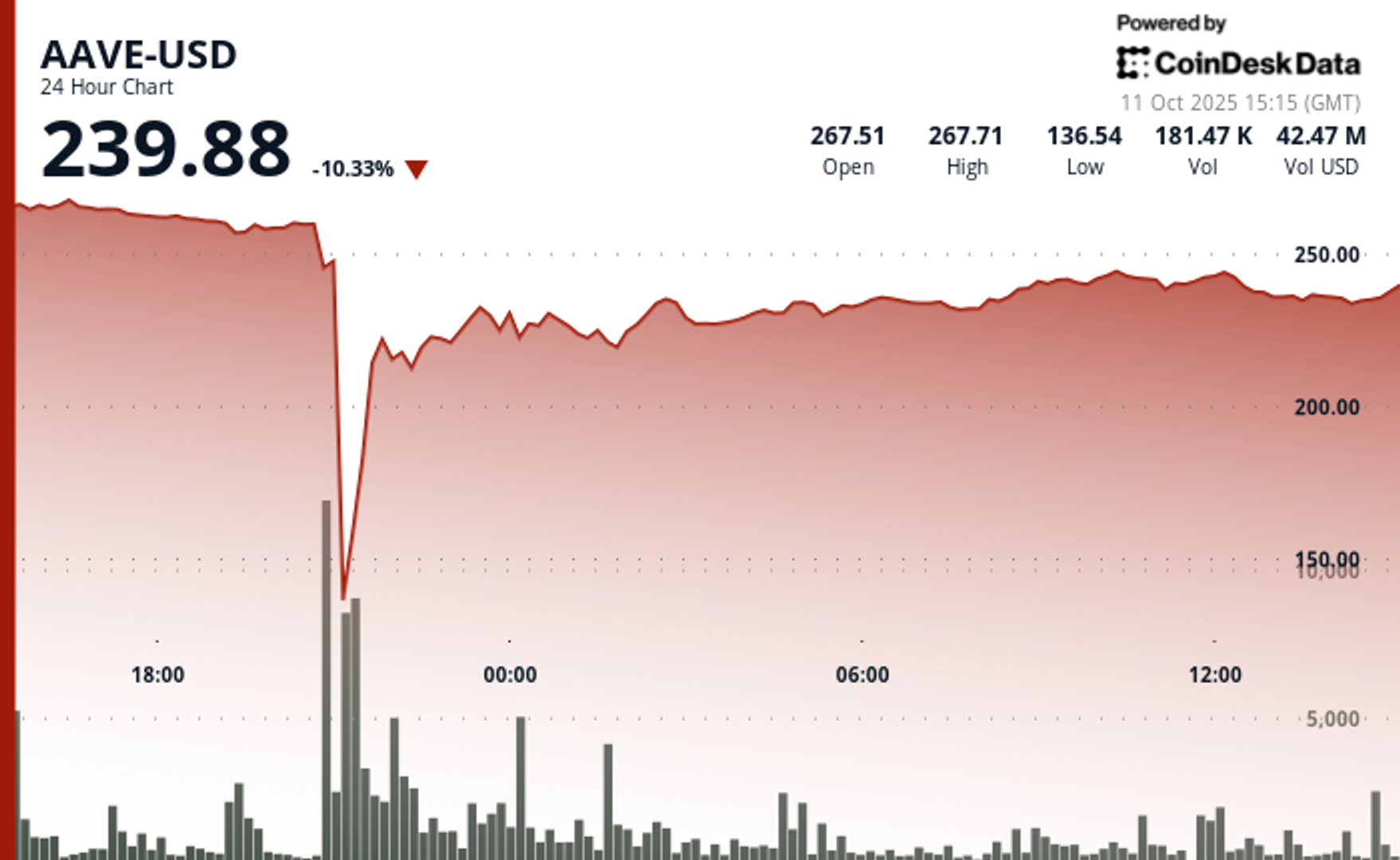

Dogecoin experienced a dramatic 50% flash crash, plummeting before stabilizing around $0.19. This sudden drop has raised concerns among investors about the volatility of cryptocurrencies, highlighting the risks involved in trading digital assets. Understanding these fluctuations is crucial for anyone involved in the crypto market, as it can significantly impact investment strategies and financial decisions.

— Curated by the World Pulse Now AI Editorial System