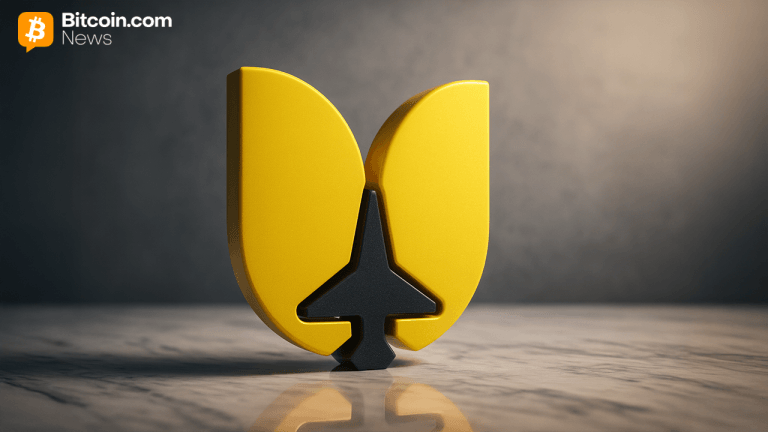

CoinShares to Acquire FCA-Regulated Bastion Asset Management

PositiveCryptocurrency

CoinShares has announced its acquisition of FCA-regulated Bastion Asset Management, marking a significant step in expanding its investment portfolio. This move not only enhances CoinShares' regulatory compliance but also strengthens its position in the competitive asset management landscape. The acquisition is expected to bring innovative financial solutions to investors, showcasing CoinShares' commitment to growth and excellence in the finance sector.

— Curated by the World Pulse Now AI Editorial System