Crypto Biz: From banks to biotechs, real-world assets move onchain

PositiveCryptocurrency

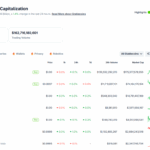

The latest developments in the crypto space are exciting as traditional finance (TradFi) continues to embrace digital assets. Tether's significant fundraising efforts, the SEC's increasing focus on onchain stocks, and JPMorgan's expansion of its Kinexys platform highlight a growing trend where banks and biotechs are integrating real-world assets into the blockchain. This shift is important as it signals a broader acceptance of cryptocurrency in mainstream finance, potentially leading to more innovative financial products and services.

— Curated by the World Pulse Now AI Editorial System