Simon Gerovich Celebrates Metaplanet Becoming Fourth Largest Bitcoin Treasury: Company Acquires Another 5268 BTC

PositiveCryptocurrency

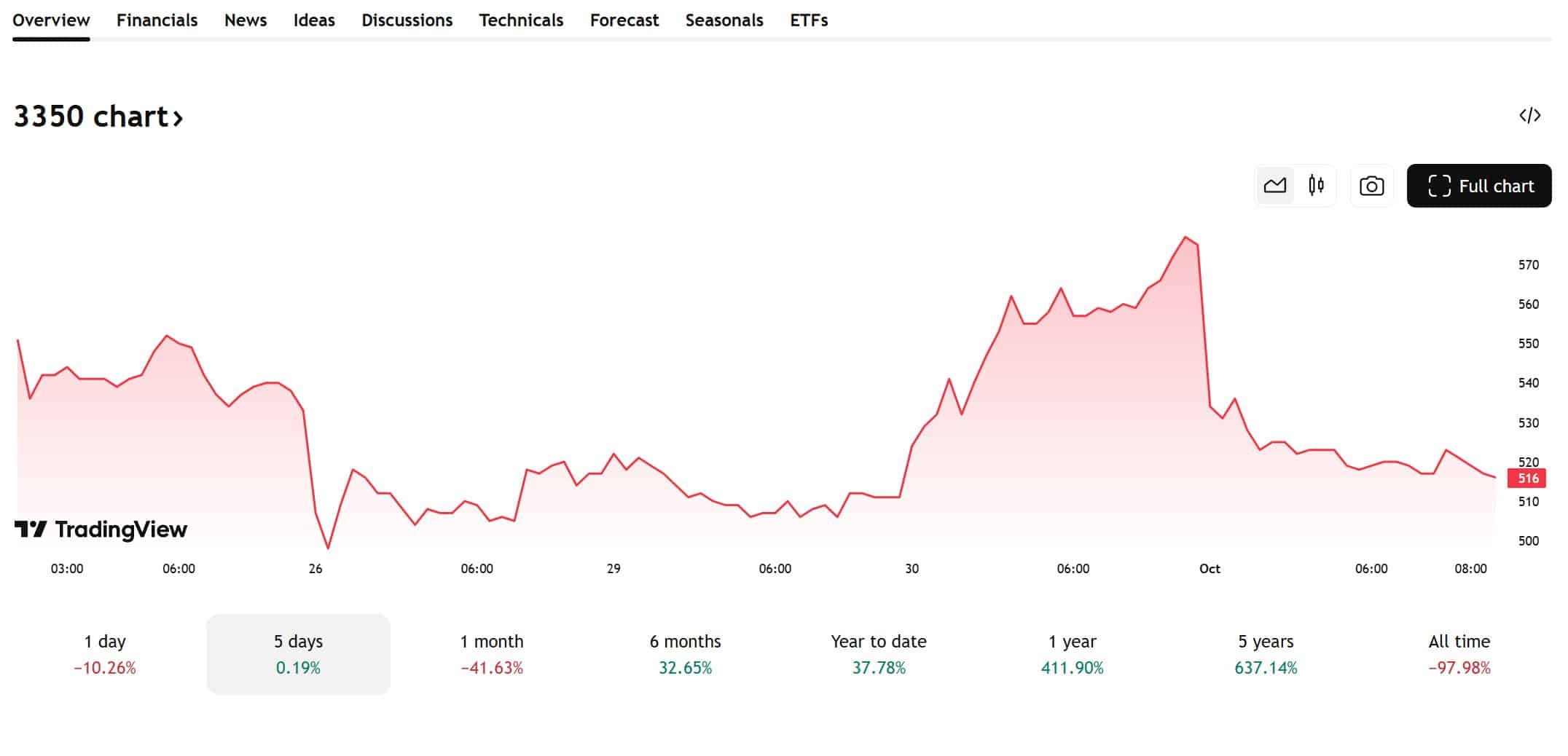

Metaplanet has made headlines by becoming the fourth largest publicly traded company in terms of Bitcoin holdings, thanks to its recent acquisition of 5,268 BTC for $623 million. This brings their total to 30,823 BTC, valued at around $3.33 billion. CEO Simon Gerovich expressed his excitement on social media, highlighting the company's significant position in the cryptocurrency market. This milestone not only showcases Metaplanet's strategic investment but also reflects the growing acceptance and importance of Bitcoin in the financial landscape.

— Curated by the World Pulse Now AI Editorial System