Democrats propose ‘restricted list’ for DeFi protocols, sparking outcry

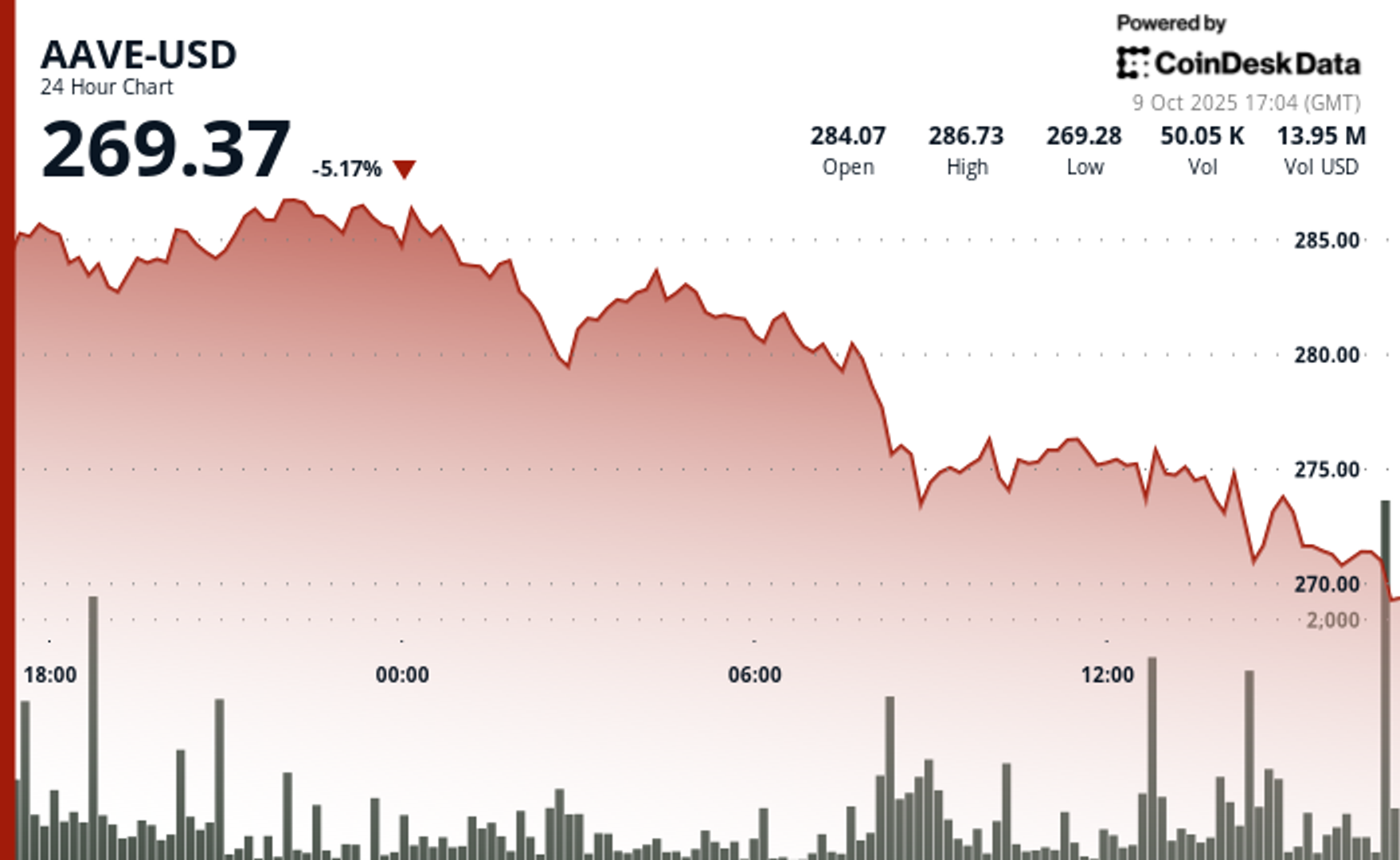

NegativeCryptocurrency

Democratic senators are facing backlash for their recent proposal to create a 'restricted list' for decentralized finance (DeFi) protocols, which many believe could severely hinder the growth of this innovative sector. This move has sparked significant outcry from the crypto community, who argue that such regulations could stifle innovation and limit access to financial services. The implications of this proposal are critical, as it could reshape the future of DeFi and impact countless users and developers in the space.

— Curated by the World Pulse Now AI Editorial System