Trump Tariff Stimulus Could Spark a Bitcoin Liquidity‑Led Bull Run

PositiveCryptocurrency

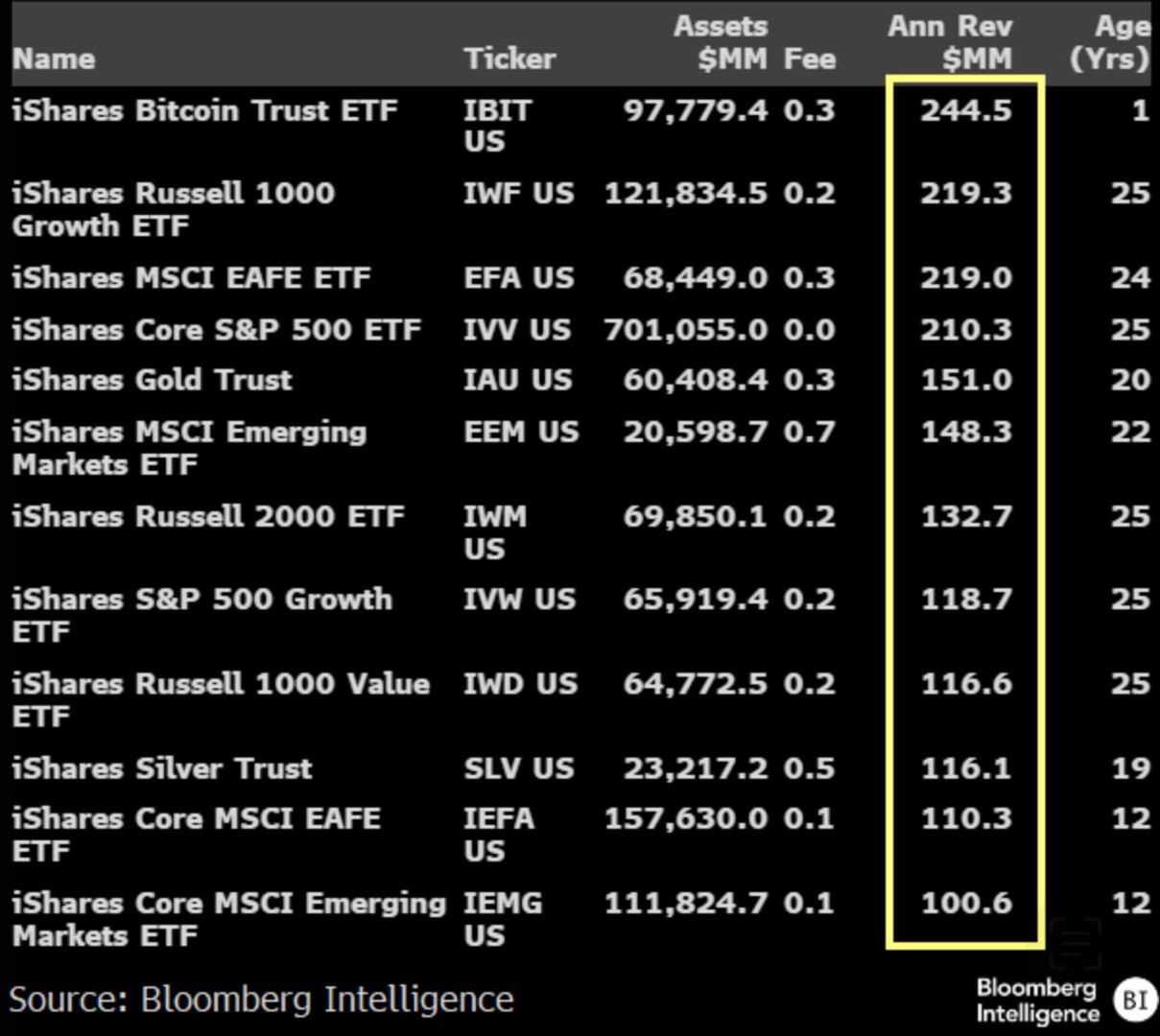

Recent discussions around a potential tariff stimulus from Trump could ignite a significant bull run in Bitcoin, driven by increased liquidity in the market. This is important as it highlights the interplay between government policies and cryptocurrency markets, suggesting that economic measures can have a direct impact on digital assets. Investors and enthusiasts are keenly watching these developments, as they could lead to a surge in Bitcoin's value and broader acceptance.

— Curated by the World Pulse Now AI Editorial System

![[LIVE] Crypto News Today, October 7 – Bitcoin USD and BNB Reach New All-Time Highs as Meme Coins Rally: Best Meme Coins to Buy in October](https://dummyimage.com/600x400/1a4a3b/ffffff.png&text=World Pulse Now)