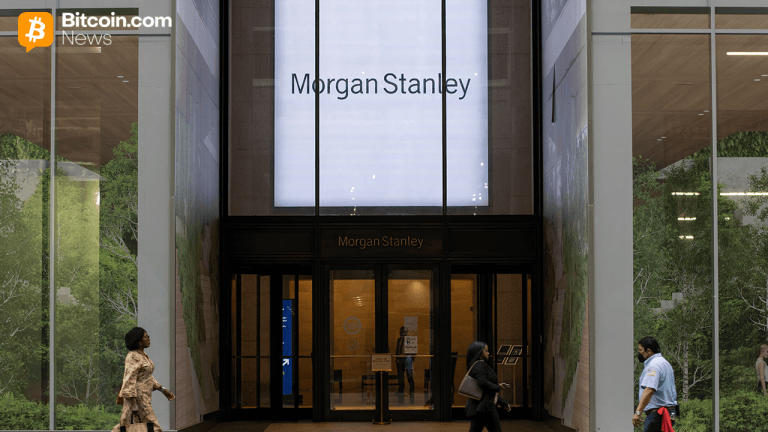

Morgan Stanley Opens Crypto Doors: All Clients Welcome To Invest

PositiveCryptocurrency

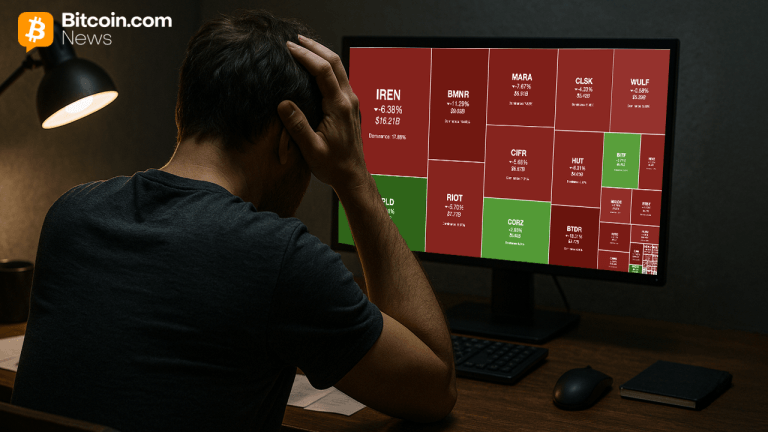

Morgan Stanley is making waves in the investment world by opening up cryptocurrency investments to all clients, including those with retirement accounts. This significant change, effective from October 15, allows financial advisors to offer crypto funds without the previous restrictions. This move not only reflects the growing acceptance of digital currencies but also provides more opportunities for investors to diversify their portfolios, making it a noteworthy development in the financial landscape.

— Curated by the World Pulse Now AI Editorial System