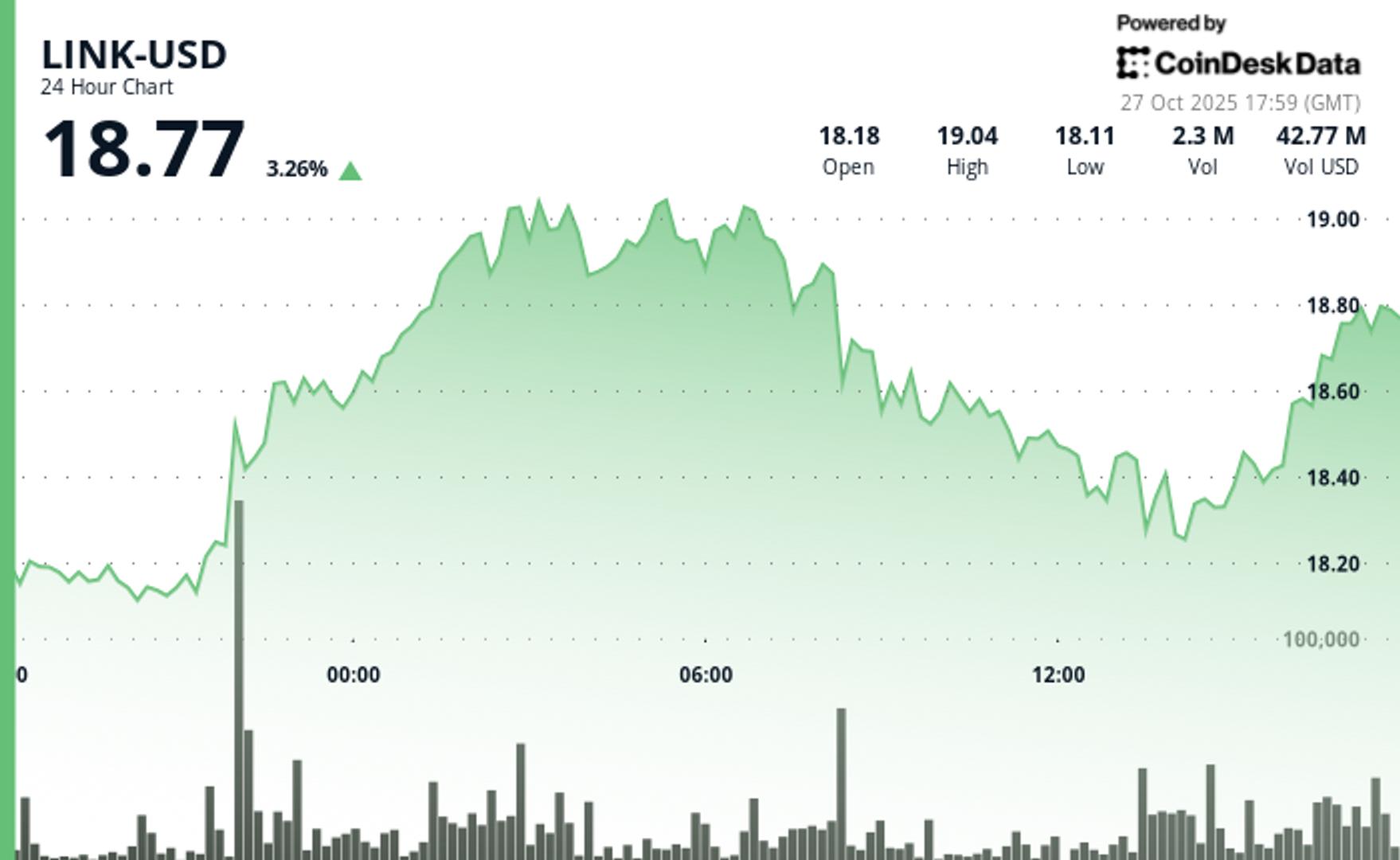

Chainlink's LINK Gains as Whales Accumulate $188M After October Crypto Crash

PositiveCryptocurrency

Chainlink's LINK token is experiencing a surge as large investors, often referred to as whales, have accumulated approximately $188 million worth of the asset following a significant crypto market downturn in October. This trend indicates a strong demand from investors, as nearly 10 million tokens were withdrawn from Binance, suggesting confidence in Chainlink's future performance. Such movements can often signal a potential recovery in the market, making it an important development for both investors and the broader cryptocurrency landscape.

— Curated by the World Pulse Now AI Editorial System