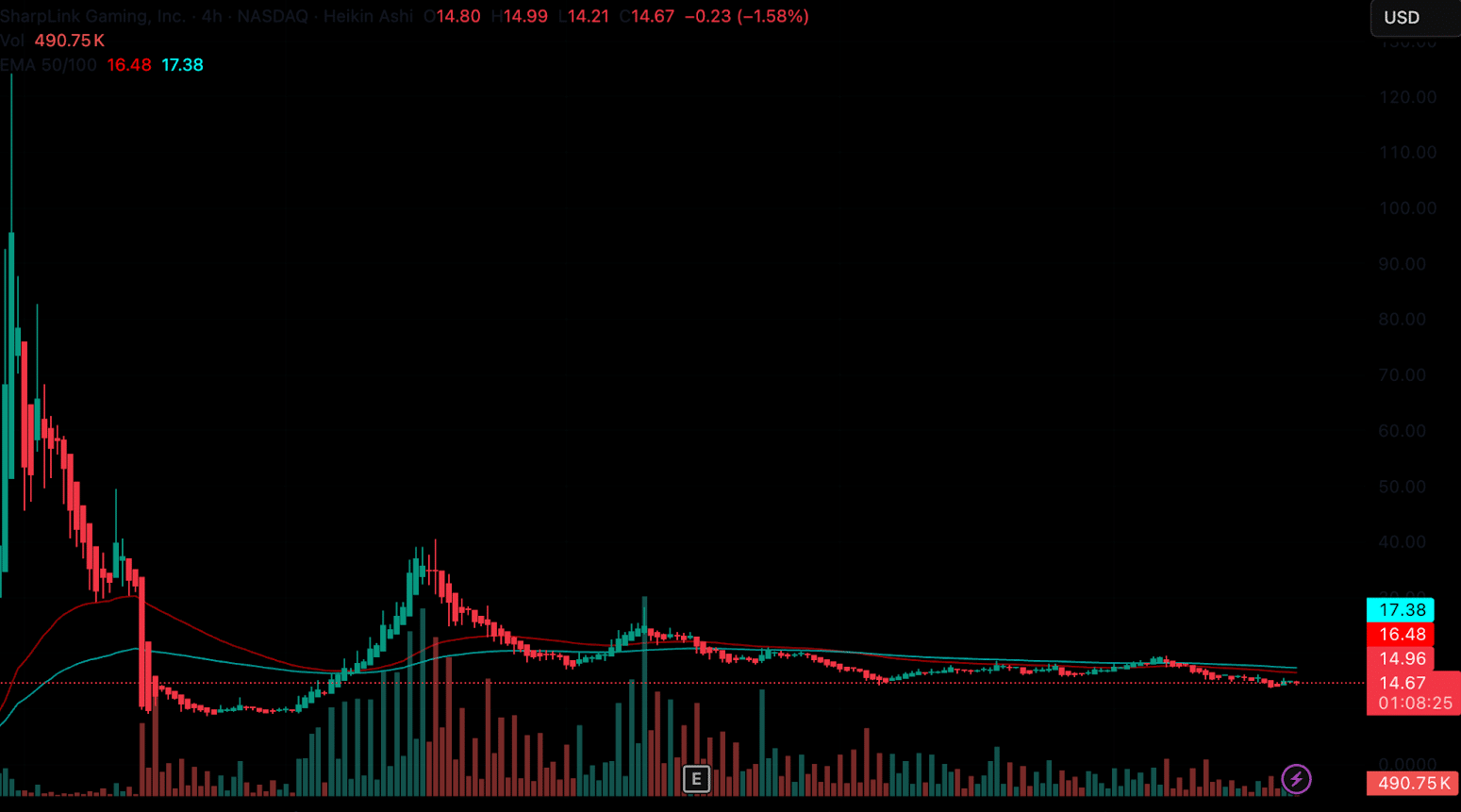

SBET Stock Continues to Tumble: Will SharpBet’s $75M ETH Bid Boost SBET Price?

NegativeCryptocurrency

SharpLink Gaming's recent $75 million investment in Ether hasn't stopped the decline of its stock, SBET. Investors are left questioning whether this significant crypto purchase can improve market sentiment and stabilize the stock price. With total holdings now nearing 859,853 ETH, the company's strategy raises concerns about its effectiveness in reversing the downward trend. This situation is crucial for investors as it highlights the volatility of the stock in relation to cryptocurrency investments.

— Curated by the World Pulse Now AI Editorial System