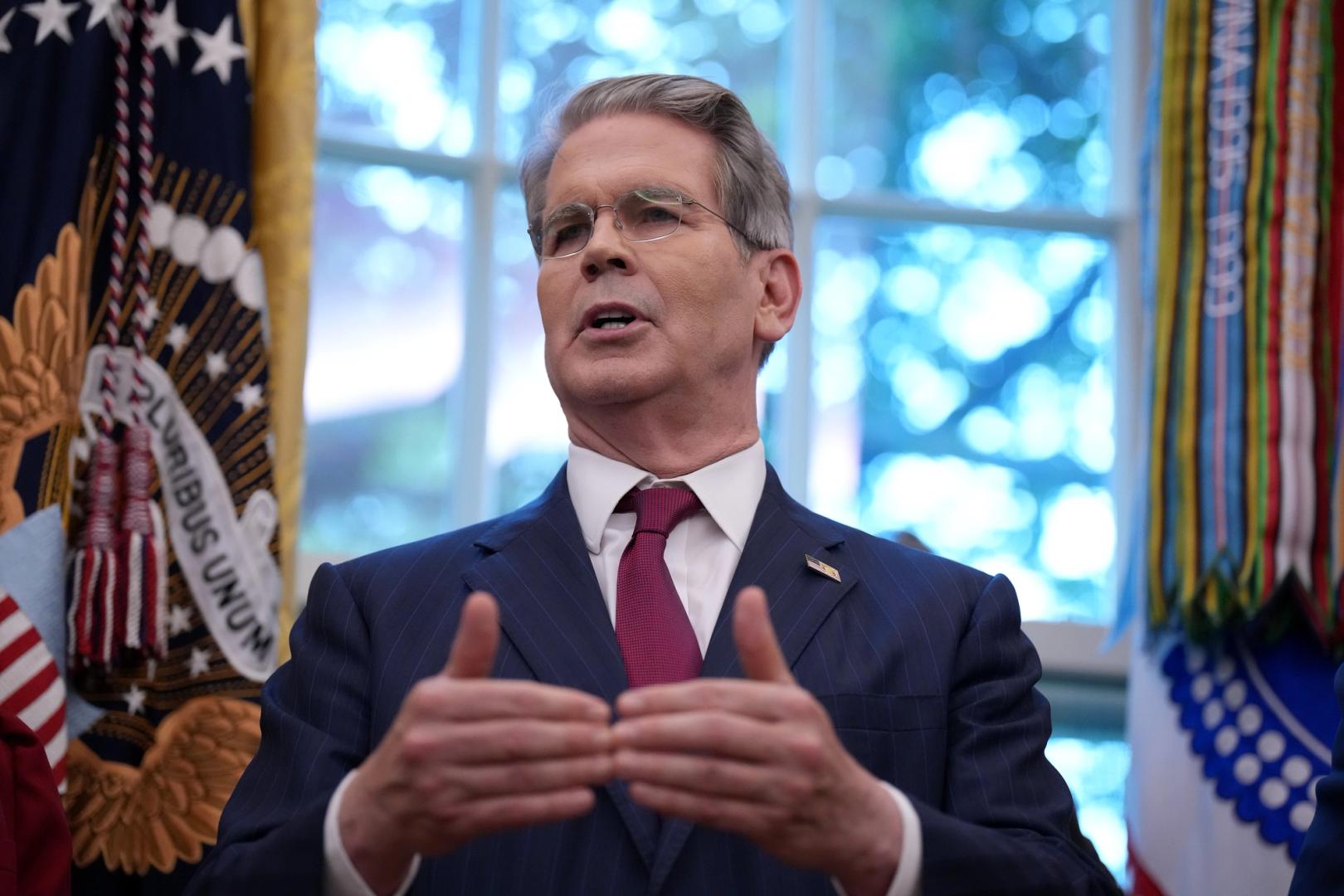

Square offers $50 Bitcoin incentive to first 20,000 merchants participating in BTC conversions

PositiveCryptocurrency

Square is making waves in the crypto world by offering a $50 Bitcoin incentive to the first 20,000 merchants who participate in BTC conversions. This initiative could significantly boost the adoption of cryptocurrency in everyday commerce, potentially transforming how payments are processed and how merchants interact with customers. It's an exciting development that highlights the growing integration of digital currencies into mainstream business practices.

— Curated by the World Pulse Now AI Editorial System