Trafigura Acquires Warehousing Firm Grafton’s Singapore Business

PositiveFinancial Markets

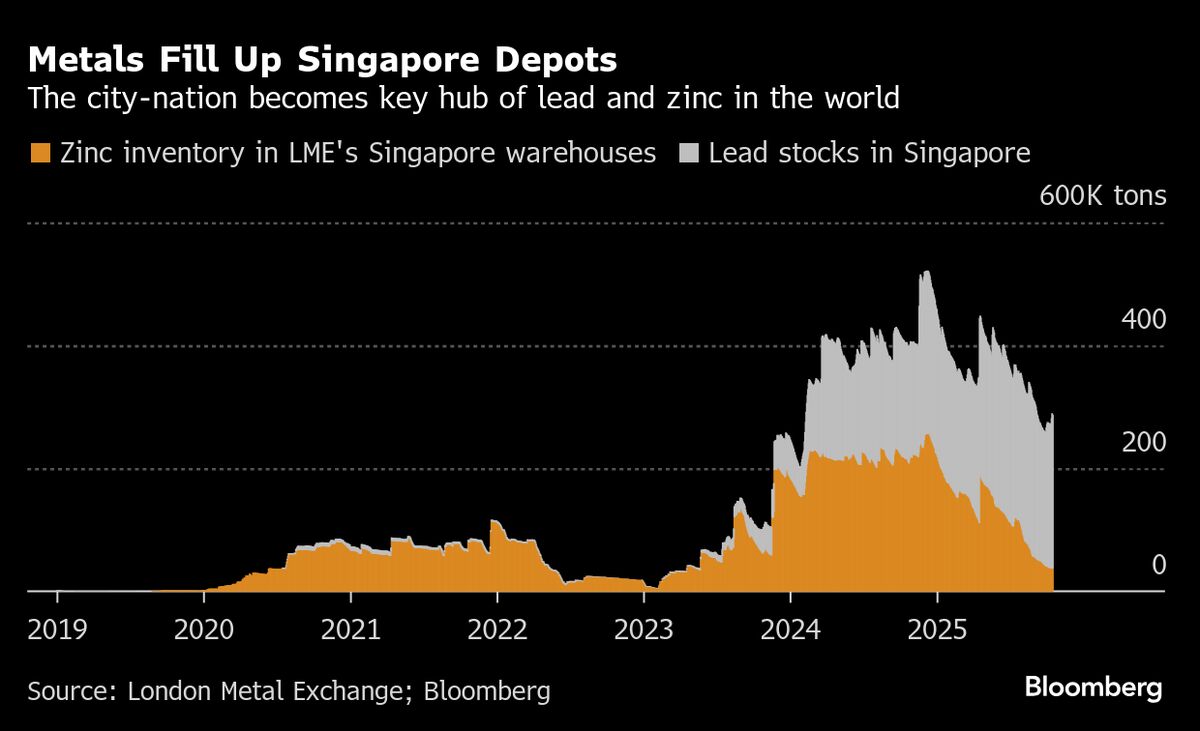

Trafigura Group's recent acquisition of Grafton's metals warehousing business in Singapore marks a significant move in the logistics sector. This acquisition is timely, as the region is currently facing a surplus inventory situation, creating new trading opportunities. By expanding its operations in Singapore, Trafigura positions itself to capitalize on these market dynamics, which could lead to increased profitability and a stronger foothold in the Asian market.

— Curated by the World Pulse Now AI Editorial System