What Interest Rate Cuts Signal About Refinancing Your Home Equity Loan

PositiveFinancial Markets

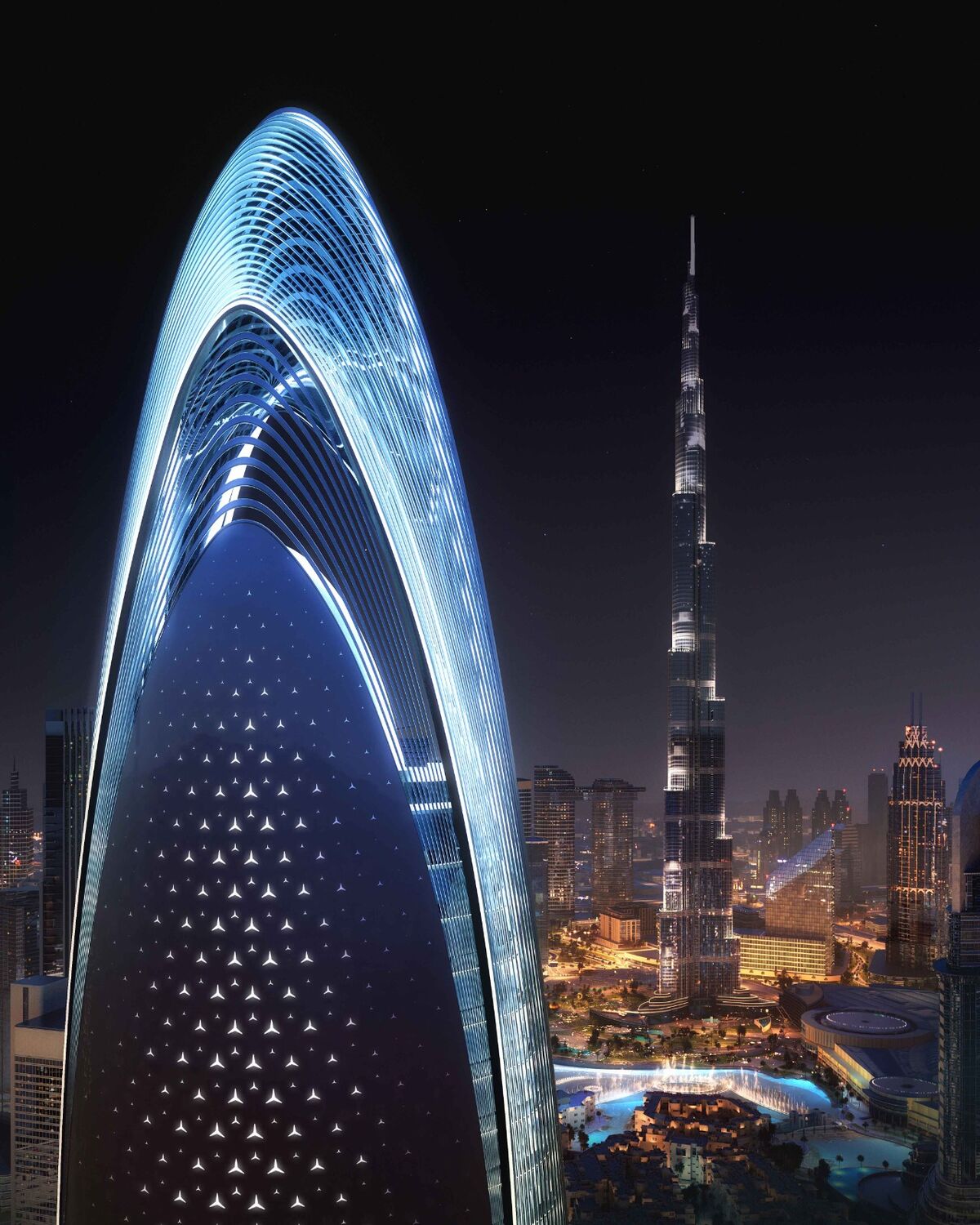

Interest rate cuts can be a great opportunity for homeowners looking to refinance their home equity loans. Lower rates mean reduced monthly payments and potential savings over time, making it an attractive option for many. This trend is significant as it not only helps individuals manage their finances better but also stimulates the housing market, encouraging more people to invest in real estate.

— Curated by the World Pulse Now AI Editorial System