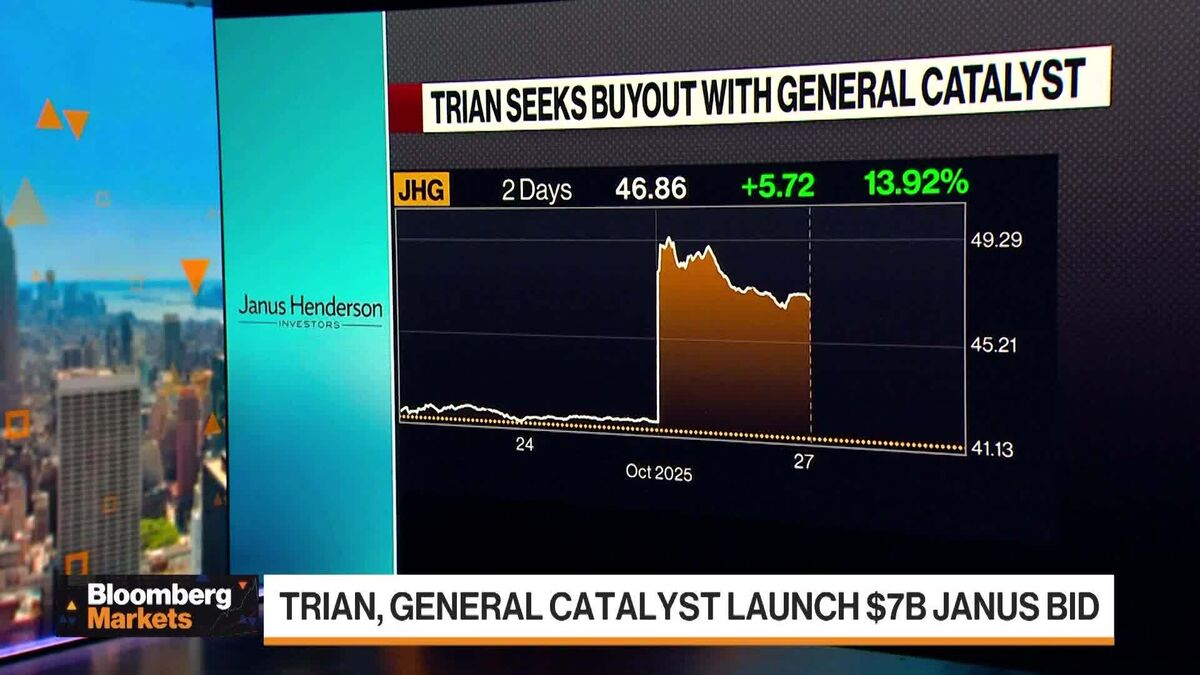

Trian Seeks Janus Henderson Buyout With General Catalyst

PositiveFinancial Markets

Activist investor Nelson Peltz is making headlines with Trian Fund Management's latest move to acquire Janus Henderson. Partnering with General Catalyst, they have proposed a buyout at $46 per share for the remaining stake in the company. This acquisition could reshape the investment landscape, highlighting Peltz's influence and strategic vision in the financial sector.

— Curated by the World Pulse Now AI Editorial System