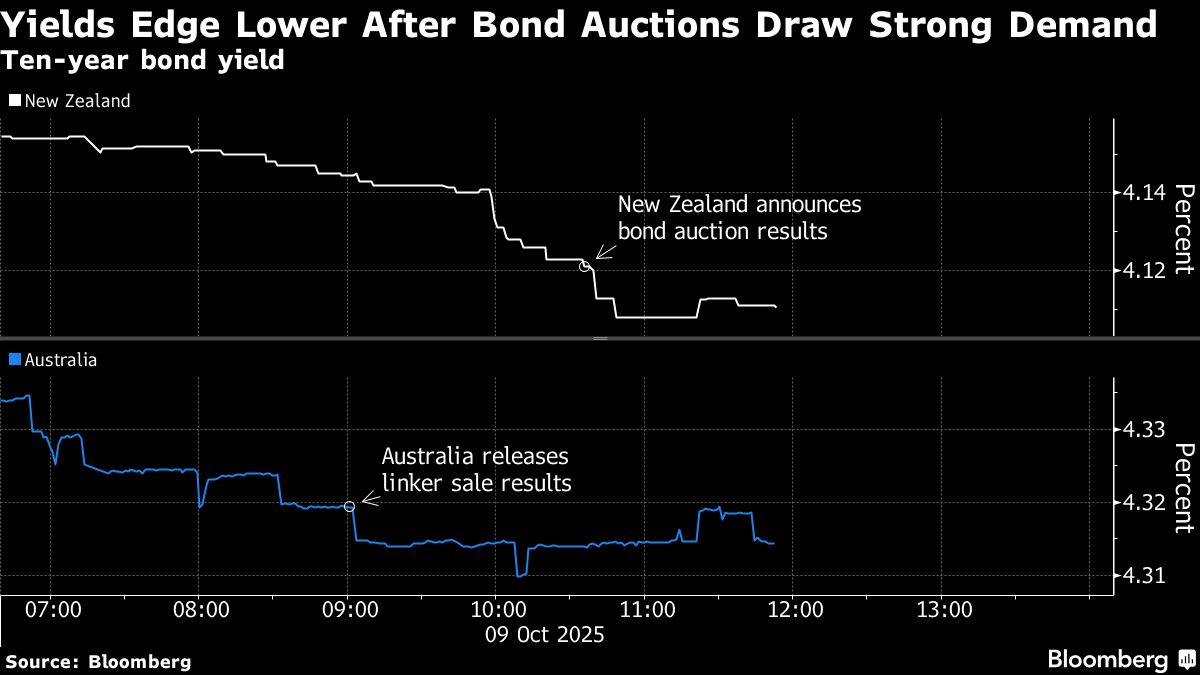

Buoyant Auctions Boost Sovereign Bonds in New Zealand, Australia

PositiveFinancial Markets

New Zealand and Australia are experiencing a positive trend in their sovereign bond markets, thanks to strong demand during recent debt auctions. This rally not only reflects investor confidence but also indicates a healthy economic outlook for both nations, making it a significant development for financial markets.

— Curated by the World Pulse Now AI Editorial System