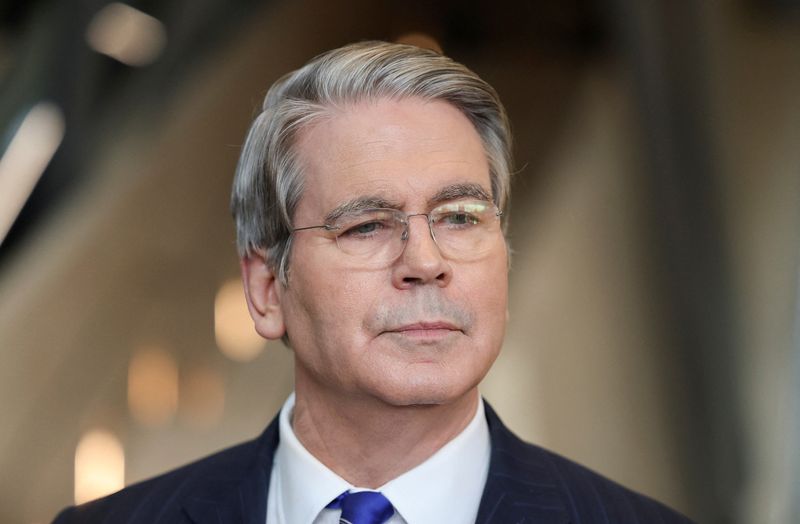

Ryerson’s Q3 revenue meets expectations despite challenging market

PositiveFinancial Markets

Ryerson's third-quarter revenue has met expectations, showcasing resilience in a challenging market environment. This achievement is significant as it reflects the company's ability to navigate economic pressures while maintaining financial stability, which is crucial for investor confidence and future growth.

— Curated by the World Pulse Now AI Editorial System